Fuel Your Business Growth with the Best Business Loans in 2025

Starting a business is like planting a garden you need sunlight, seeds, and, most importantly, fertile ground (aka money) to make it flourish.

Whether you’re nurturing a startup or expanding an established business, finding the right small business loan in Canada is like choosing the right soil you need the right mix to help you bloom.

But with so many options from private lenders to government-backed programs it can feel like wandering through a financial jungle.

Which path should you take?

Who do you trust with your dreams (and your debt)?

Buckle up. We’re about to navigate the small business lending landscape in Canada together, and by the end, you’ll know exactly how to choose the best financing for your next big move.

Why Business Loans in 2025 Are Critical for Your Company’s Growth

Let’s be real: in today’s economy, cash is king, queen, and court jester.

Even the best ideas flop without enough capital.

Need to hire that top-notch marketer?

Launch a jaw-dropping website?

Buy equipment that doesn’t belong in a museum?

Yup, you need funding. And small business loans can be the lifeline between “good idea” and “grand opening.”

Your Main Options: Private Lending vs Government-Backed Loans

Imagine two bridges crossing the same river:

-

Private Lenders: Fast, flexible, and a little expensive. Think of it like paying for an express toll lane.

-

Government-Backed Loans (like CSBFP): Slower, steadier, and often cheaper. It’s like taking the scenic route—longer, but with fewer bumps.

Let’s dive deeper.

Private Business Loans (The Wild West of Lending)

Private lenders offer you term loans, lines of credit, merchant cash advances, and peer-to-peer lending options.

They’re fast—sometimes funding you within 24–48 hours—but they charge for that speed.

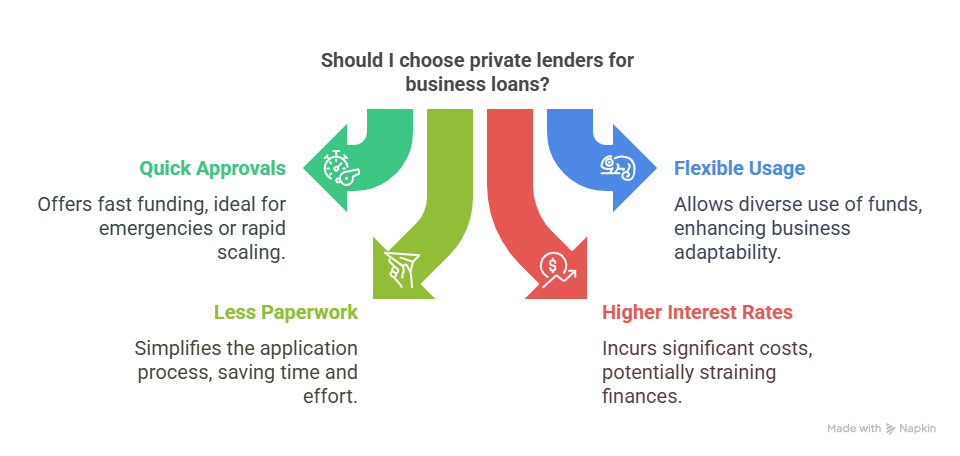

Pros of Private Lenders

-

Quick approvals (sometimes same-day)

-

Flexible usage (marketing, payroll, pizza parties… okay, maybe not pizza parties)

-

Less paperwork

Cons of Private Lenders

-

Higher interest rates (sometimes 8% to 29% or more)

-

Tougher repayment terms

-

Sneaky fees if you’re not careful

Private lending is like hiring a helicopter—fast but pricey. Great for emergencies or rapid scaling.

Government-Backed Loans (CSBFP: Your Reliable Workhorse)

The Canada Small Business Financing Program (CSBFP) is like having a big brother backing you up when you apply for a loan.

It helps businesses with under $10 million in revenue access up to $1 million in funding through participating banks like CIBC, RBC, or Scotiabank.

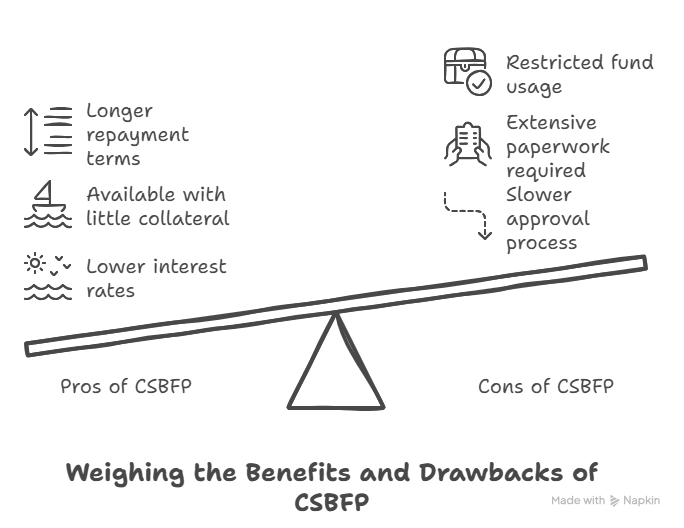

Pros of CSBFP

-

Lower interest rates (Prime + 3%)

-

Available even if you’re new or have little collateral

-

Longer repayment terms

Cons of CSBFP

-

Slower approval (think weeks, not days)

-

Lots of paperwork

-

Funds must be used for eligible purposes (no Vegas trips)

CSBFP is your safe, sturdy tractor—slow, steady, and built to carry heavy loads over long distances.

Am I Eligible? Let’s Find Out

Getting a loan isn’t like grabbing a coffee.

Lenders will peek into your financial soul before handing you a cheque.

Private Lending Eligibility

- 6+ months in business (minimum)

- $10,000+ monthly revenue

- 600+ credit score (preferably)

CSBFP Eligibility

- Canadian-operated business

- Less than $10M in annual revenue

- Not a farming business (different programs exist for farmers)

- Solid business plan if you’re a startup

Ask yourself: Can you show them you’re real, reliable, and ready to repay?

If yes—you’re halfway there.

How Much Can You Borrow? (Show Me the Money!)

Here’s where things get spicy

| Lender Type | Max Loan Amount | Special Conditions |

|---|---|---|

| Private Lenders (WOWA.ca etc.) | Up to $1.5M | Depends on creditworthiness |

| CSBFP (Gov’t-backed) | Up to $1M | $500K cap on equipment/leaseholds, $150K for working capital |

Private lenders are the “go big or go home” types.

CSBFP is more structured, like a well-organized IKEA catalog.

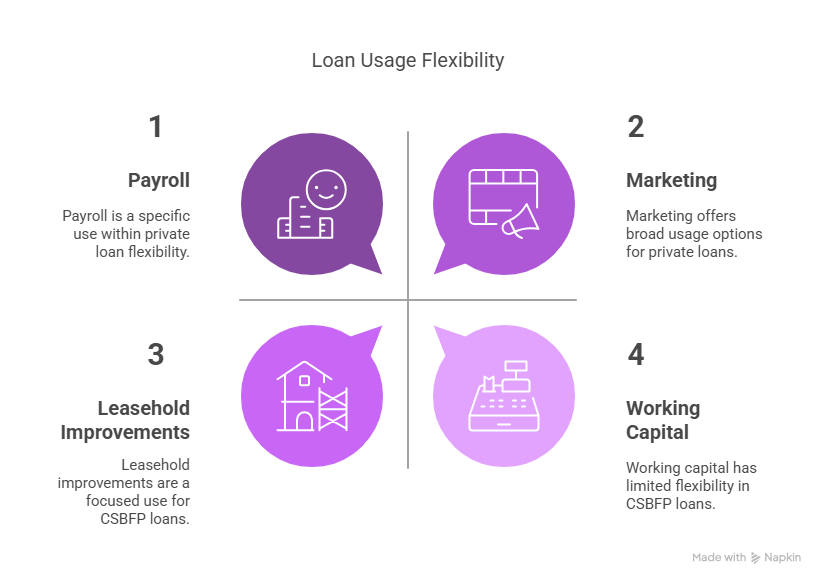

What Can You Actually Use the Money For?

Not every dollar is a free-for-all.

Private Loans: Wide Open

-

Working capital

-

Marketing

-

Payroll

-

Equipment

-

Inventory

-

Expansion

CSBFP Loans: Focused Mission

-

Buying or upgrading property

-

Equipment purchase

-

Leasehold improvements

-

Working capital (with limits)

Private loans are like a buffet—you can pile your plate high with whatever you want.

CSBFP loans are more like a set menu—you get a curated, gourmet meal.

Interest Rates: How Much Will It Cost You?

Spoiler: borrowing money isn’t free. (Wouldn’t that be nice?)

Private Lenders

-

8% to 29% interest

-

Additional fees (origination, servicing, early repayment)

CSBFP Loans

-

Prime Rate + 3% (floating) or

-

Base mortgage rate + 3% (fixed)

-

2% registration fee (can be rolled into the loan)

Private lending is like paying a cover charge for a VIP club.

Government-backed loans are more like paying a reasonable fee to join a private country club.

Security and Guarantees: What’s the Collateral?

Private Loans

-

May require personal guarantees

-

Sometimes need collateral

CSBFP Loans

-

MUST secure against the asset financed

-

Lenders may ask for personal guarantees too

Translation? Have something valuable they can “hold onto” if things go sideways.

The Application Process: It’s Showtime!

Applying for a business loan can feel like starring in your own courtroom drama.

Here’s what you’ll need:

For Private Lenders

-

Online form

-

Proof of revenue

-

Bank statements

-

Fast turnaround (sometimes same day!)

For CSBFP

-

Business plan (especially for startups)

-

2 years of financials

-

Personal and business tax returns

-

Photo ID

-

Patience. Lots of patience.

Private loans are speed dating.

CSBFP loans? They’re a full-blown courtship.

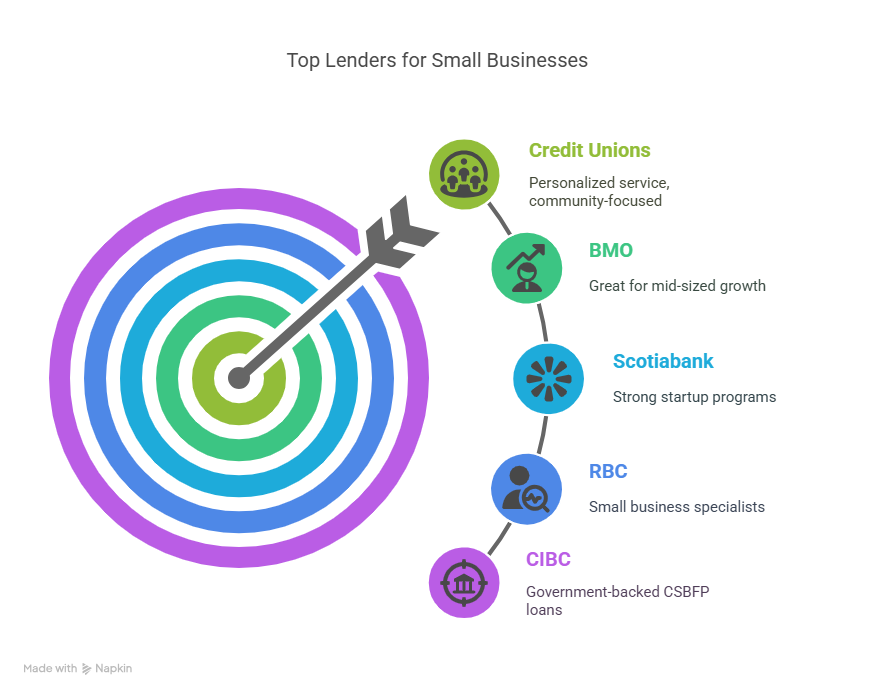

Top Lenders You Should Know About

Ready to make a move? Here’s your “cheat sheet”:

-

WOWA.ca lenders: Fast, flexible funding

-

CIBC: Government-backed CSBFP loans

-

RBC: Small business specialists

-

Scotiabank: Strong startup programs

-

BMO: Great for mid-sized growth

-

Credit Unions: Personalized service, community-focused

Choose wisely, young Padawan.

Choosing the Right Loan: Final Thoughts

At the end of the day, it’s all about fit.

-

Need fast money? Private lending is your highway.

-

Want lower rates and more stability? CSBFP is your scenic route.

-

Startup with no revenue yet? Build a killer business plan and knock on a CSBFP bank’s door.

Your small business deserves a financial partner who gets it.

Don’t just chase dollars—build a strategy.

Conclusion: Plant the Seeds Today, Harvest the Success Tomorrow

Business loans aren’t just about money—they’re about momentum.

They’re the silent partner standing behind you when you take that next daring leap.

With the right financing—smartly chosen, wisely used—you’re not just surviving.

You’re thriving, expanding, hiring, innovating, and owning your future.

So whether you choose the express lane or the scenic route, just keep moving forward.

The garden you plant today?

That’s tomorrow’s success story.

🌱 Dream bigger. Fund smarter. Win faster.

FAQs

Can I get a small business loan with bad credit?

Yes! Some private lenders focus on business cash flow rather than personal credit scores. CSBFP loans usually require better credit, but strong financials or a great business plan can help.

What’s the difference between a line of credit and a term loan?

A line of credit is like a credit card—use what you need, pay interest only on what you use. A term loan is lump-sum funding with fixed repayments.

How long does it take to get funded?

Private lenders can approve and fund within 24–72 hours. CSBFP loans through banks usually take 2–6 weeks.

Can I refinance a private loan with a CSBFP loan later?

Possibly, if you qualify! Refinancing can help lower your interest rates and improve cash flow if done strategically.

Are there grants available for small businesses too?

Absolutely! In addition to loans, Canada offers grants for innovation, hiring, technology upgrades, and more. Loans require repayment—grants don’t!