Syndicated Mortgages in Canada: Real Estate Goldmine or Financial Trap?

May 21, 2025

No Comments

Read More »

Fixed vs. Variable Rate Mortgages in 2025: Which One’s Right for You?

May 15, 2025

No Comments

Read More »

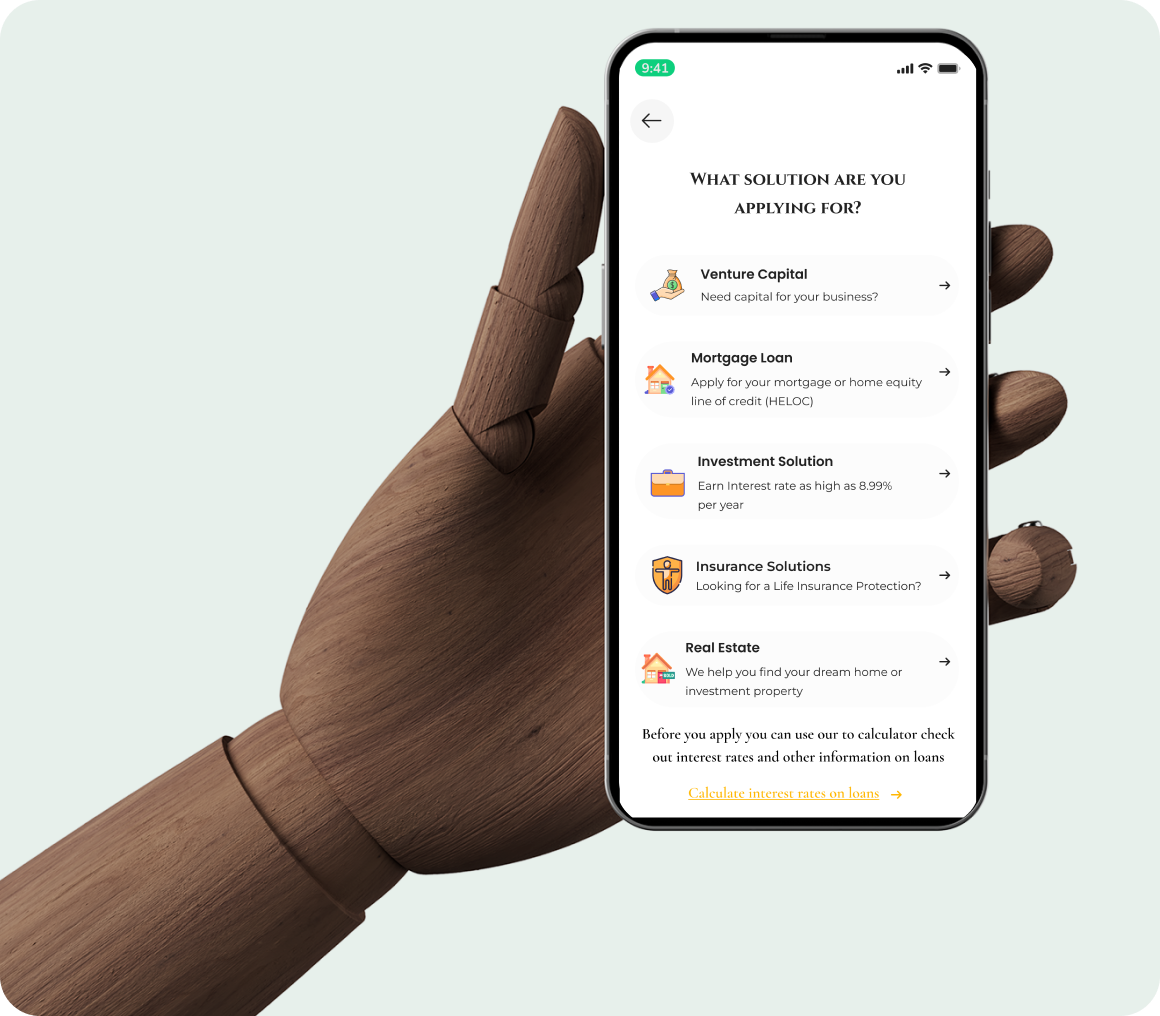

Our Loan Application

Get a loan approved in less than 24 hours

We have assisted many Canadians in securing funds to realize their financial objectives

PROJECTS FUNDED ACROSS DIFFERENT REGIONS

We take pride in our extensive portfolio of properties located across the globe, including the UAE, Portugal, Canada, Spain, and Mexico. To explore your interests further, simply click the “Get Started” button to proceed.

Luxury Home in Toronto

Luxury Apartment In Dubai

What People Say

“Impressed with the hassle-free loan process at Dunamis Capital. They made it easy, quick, and transparent. Highly recommended”

Jason Moore

Ontario, Canada

“Top-notch customer support at Dunamis Capital. Any questions I had about my loan were answered promptly. Great service”

Catherine Smith

Ontario, Canada

“Dunamis Capital exceeded my expectations in guiding me towards smart investment choices. Their personalized approach sets them apart”

Fred Johnathan

Ontario. Canada

“Exceptional financial partner! They understand individual needs, offering a range of solutions tailored to different financial situations.”

Femi Adesina

Ontario, Canada

“Quick approvals, clear terms, and competitive rates – They made my loan experience smooth and stress-free. Five stars”

Maria fox

Ontario, Canada

“ Dunamis Capital is a game-changer in financial partnerships, their expertise and innovation stand out. Highly recommended..”

Mila Jackson

Ontario, Canada