Commercial Mortgages Made Simple (Canada & Ontario Guide)

Thinking of buying or refinancing a commercial property? Let’s break it down.

Navigating the world of commercial mortgages in Canada can feel like walking into a boardroom where everyone speaks a different financial language. Whether you’re a small business owner eyeing a new warehouse in Toronto, an investor planning to redevelop a retail plaza, or just someone thinking about expanding your real estate footprint, one thing is clear: you need to understand commercial mortgages like a boss.

Let’s walk through the must-know details, without the banker jargon. From interest rates and loan terms to Ontario-specific quirks and insider advice, this is your go-to guide.

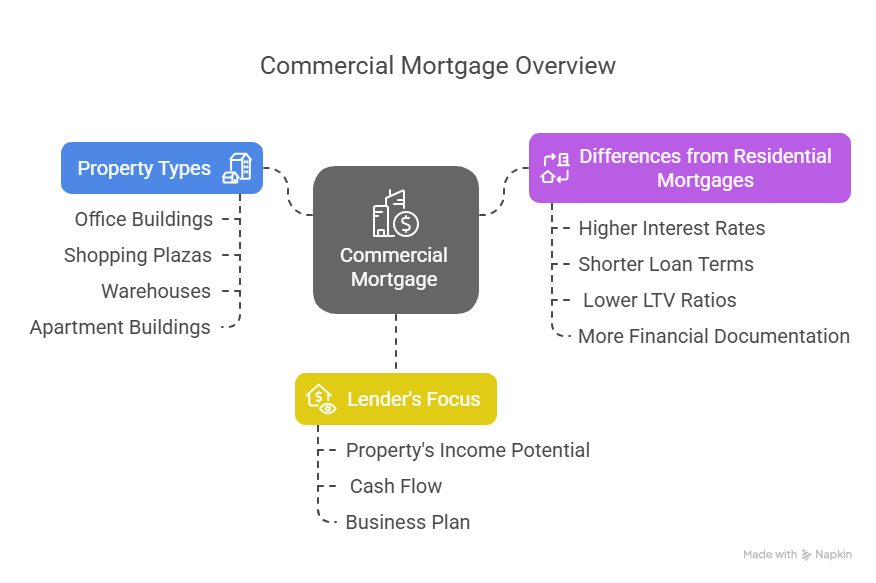

What Is a Commercial Mortgage, Anyway?

Put simply, a commercial mortgage is a loan used to buy or refinance property that’s used for business purposes. Think office buildings, shopping plazas, warehouses, apartment buildings with 5+ units, and more.

Unlike residential mortgages, which are built for homeowners, commercial loans are for wealth builders—the entrepreneurs, the dreamers, the developers.

Why It’s Different from a Residential Mortgage

Here’s the catch: commercial mortgages play by different rules.

-

Higher interest rates

-

Shorter loan terms

-

Lower loan-to-value (LTV) ratios

-

More financial documentation

-

A big emphasis on your property’s income potential

In other words, the lender isn’t just betting on you—they’re betting on your property, your cash flow, and your plan.

Key Features of a Commercial Mortgage in Canada

🧾 Property Types That Qualify

You’ll need a property that’s zoned for business use. This can include:

-

Office spaces

-

Retail stores

-

Medical clinics

-

Multi-residential buildings (5+ units)

-

Mixed-use properties (like a shop on the main floor and apartments above)

In Ontario, the zoning is verified through the land registry, which determines whether it qualifies for commercial financing.

📉 Loan-to-Value Ratio (LTV): How Much Can You Borrow?

Unlike residential mortgages that can go up to 95% LTV with insurance, commercial mortgages typically cap out at 75% LTV—and in some cases, as low as 50%.

Here’s how it breaks down:

| Property Type | Typical LTV |

|---|---|

| Mixed-use | 65% – 75% |

| Pure commercial | 50% – 65% |

| Apartment buildings | Up to 75% |

Down payment required? Yep. Most lenders want at least 25%–35% down.

💸 Interest Rates & Amortization Terms

Interest Rates

Expect to pay a bit more than you would for your home mortgage. Commercial loans usually range from 6% to 9%, depending on the lender, your credit, and the type of property.

Loan Term vs. Amortization

This is where it gets spicy:

-

Loan term: 1 to 10 years

-

Amortization: 15 to 25 years

What happens at the end of your term? Balloon payment time. Unless you refinance, you’ll need to repay the balance—or sell.

📋 Qualification Requirements: Are You Eligible?

Let’s be honest: it’s not just about your credit score here. Lenders want to see that you’ve done your homework.

Here’s what they usually ask for:

-

2 years of business financials

-

Personal net worth statement

-

Credit reports (personal & commercial)

-

Environmental Report (Phase I)

-

Appraisal by an AACI-designated appraiser

-

Lease agreements (for rental properties)

-

Business plan or forecast

Basically, your lender wants to know: “Is this a smart investment?”

Breaking Down the Advice: What Do the Experts Say?

We looked at the top three resources for commercial mortgages in Canada and Ontario: BDC, WOWA.ca, and MortgageBrokerStore.com. Here’s what we found.

BDC – The Government’s Business Lender

What They Offer:

BDC is Canada’s bank for entrepreneurs, and they know their stuff. Their advice is geared toward long-term investors and growing businesses.

BDC Highlights:

-

Focus on business viability and property revenue

-

Emphasis on environmental compliance

-

Nationwide approach

Downside?

Not as much granular detail on local Ontario lending rules.

WOWA.ca – Canada’s Mortgage Comparison Powerhouse

What They Offer:

WOWA is a platform that compares commercial mortgage rates from dozens of lenders. Their info is practical and updated frequently.

WOWA Highlights:

-

Emphasizes rate shopping

-

Good for beginners and intermediates

-

Broad national coverage

Downside?

Limited in-depth info on lender-specific underwriting.

MortgageBrokerStore.com – Ontario-Focused & Investor-Friendly

What They Offer:

These folks get local. They cater to real estate investors and businesses in Ontario, and they don’t sugarcoat things.

MortgageBrokerStore Highlights:

-

Extensive list of required documents

-

LTV specifics for mixed-use and pure commercial

-

Notes about CMHC insurance and zoning

Downside?

Not ideal for borrowers outside Ontario.

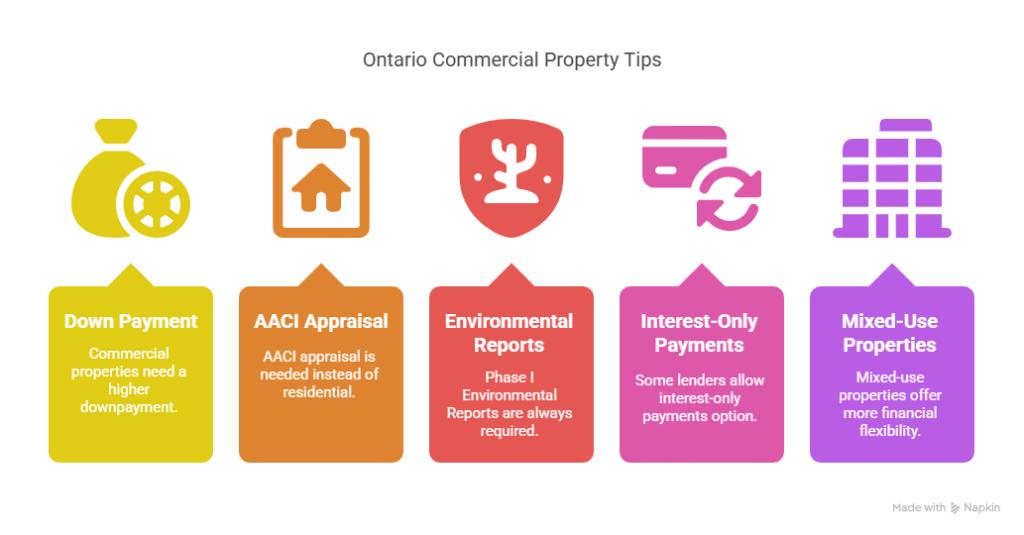

Ontario-Specific Insights You Shouldn’t Miss

Ontario is a different beast. Here are a few tips just for this province:

-

Pure commercial properties often require 30%–50% down

-

You’ll need an AACI appraisal, not just a regular residential one

-

Phase I Environmental Reports are non-negotiable

-

Some lenders allow interest-only payments to improve cash flow

-

Mixed-use = more flexibility

CMHC and Commercial Mortgages: Is There Coverage?

Here’s the scoop:

-

CMHC usually does NOT insure pure commercial properties

-

BUT… if your property is mixed-use (like retail below, apartments above), you might be eligible

Always confirm with your mortgage broker.

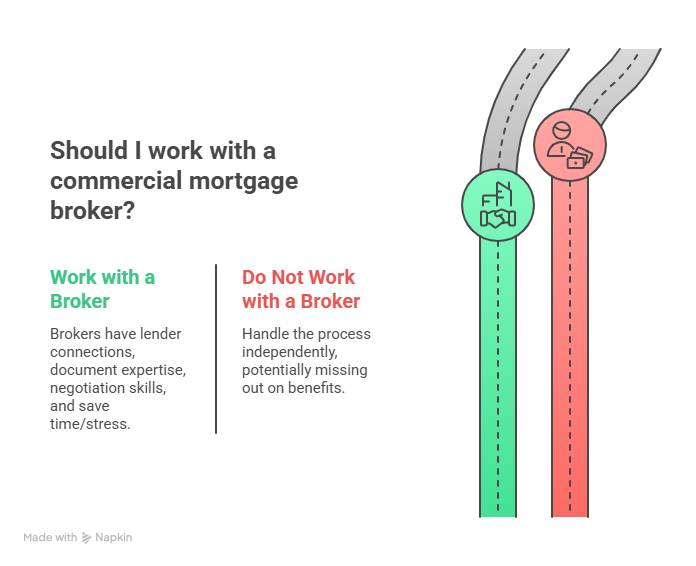

Should You Work With a Broker? (Short Answer: YES)

A good commercial mortgage broker is worth their weight in gold.

Here’s why:

-

They know the lenders who actually fund commercial deals

-

They help you package your documents correctly

-

They negotiate better rates

-

They save time and stress

Think of them like your financial real estate quarterback.

Conclusion: Invest Smart with the Right Mortgage

A commercial mortgage isn’t just a loan—it’s a tool for business growth, wealth creation, and strategic investing. Whether you’re eyeing a corner storefront or a 30-unit apartment building, knowing how commercial lending works is your first step to making a smart move.

📌 The key? Understand your numbers. Document everything. Get expert help.

And always choose lenders and brokers who understand your business goals—not just their bottom line.

FAQs

Can I get a commercial mortgage with bad credit?

Yes, but expect higher interest rates and stricter terms. Private lenders may offer more flexibility than banks.

Is it easier to get a mortgage for a mixed-use property?

Generally, yes. Mixed-use buildings often qualify for better LTV ratios and more lenient terms—especially if part of the property is residential.

What’s the difference between a commercial appraisal and a residential one?

Commercial appraisals are more detailed and must be done by AACI-designated appraisers. They analyze income potential, lease value, and market trends.

Can I refinance an existing commercial mortgage?

Absolutely. Many investors refinance to pull out equity, get better rates, or consolidate loans.

How long does it take to get approved?

It varies by lender. Traditional banks may take 4–8 weeks. Private lenders can approve deals in as little as 3–10 business days.