Build your dream home in Canada with our 2025 construction loan guide!

Thinking about building a home in Canada? Whether you’re crafting a modern minimalist escape in Vancouver or a charming countryside cabin in Ontario, you’re going to need more than just inspiration and blueprints—you’ll need the right financing. That’s where construction loans come in.

Unlike a traditional mortgage, construction loans are short-term, flexible financing options specifically designed to support your build from the first shovel in the ground to the final coat of paint. In this ultimate 2025 guide, we’ll walk you through everything you need to know about construction loans in Canada—powered by insights from WOWA.ca, one of the country’s top resources for connecting borrowers with construction financing.

🏗️ What Is a Construction Loan in Canada?

A construction loan is exactly what it sounds like: a loan that funds the construction of a new home or major renovation. But here’s the twist—it doesn’t give you the full amount all at once. Instead, money is released in stages or “draws” as construction progresses. Think of it like drip-feeding your project the funds it needs to grow.

And once your home is built? That short-term construction loan is usually refinanced into a long-term mortgage.

🔍 How Do Construction Loans in Canada Work?

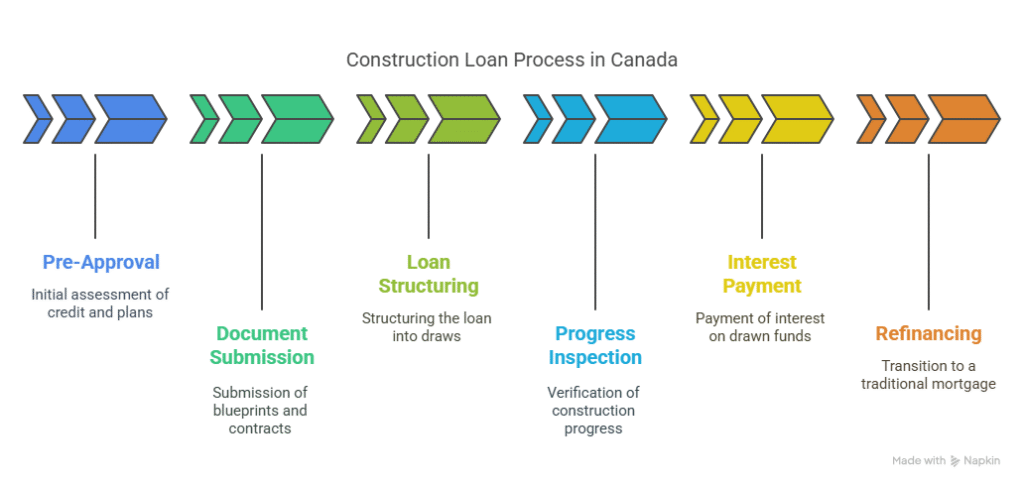

Here’s the typical process:

-

You get pre-approved based on your credit, income, and plans.

-

You submit blueprints, budgets, permits, and builder contracts.

-

Your loan is structured in draws (e.g., foundation, framing, roofing, completion).

-

Inspectors verify progress before each draw is released.

-

You pay interest only on the funds drawn (not the full amount).

-

Once completed, you refinance into a traditional mortgage.

That’s the blueprint in a nutshell. But there’s more to know—especially when it comes to qualifying.

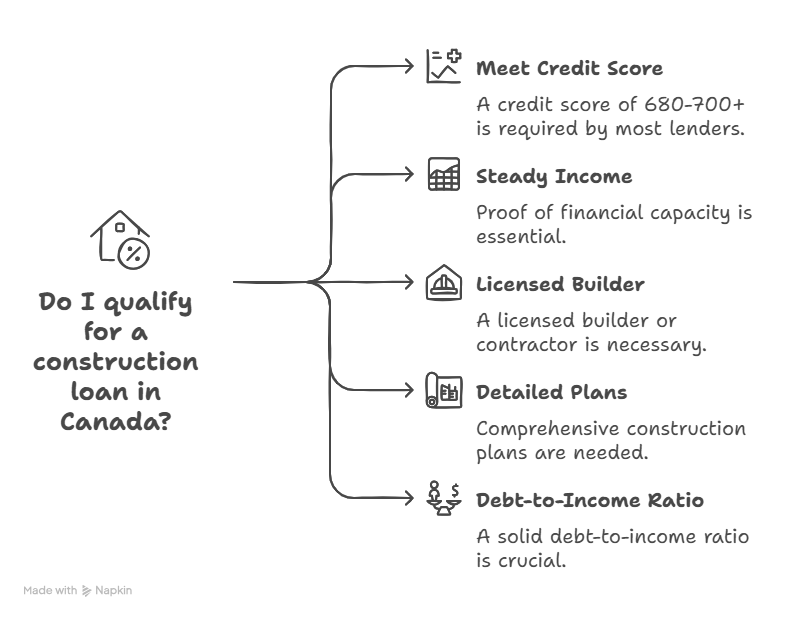

✅ Who Qualifies for a Construction Loan in Canada?

Lenders aren’t handing out money to just anyone with a dream and a Pinterest board. You’ll need to come prepared. According to WOWA.ca, most lenders require:

-

A minimum credit score of 680–700+

-

A steady income or proof of financial capacity

-

A licensed builder or general contractor

-

Detailed construction plans, including:

-

Architectural drawings

-

Construction timeline

-

Permits and zoning approvals

-

Cost estimates and materials list

-

-

A solid debt-to-income ratio

Self-building? Some lenders do allow owner-builders, but expect extra scrutiny.

💰 What About the Down Payment?

Here’s the part that can surprise people: you can’t borrow 100% of the cost.

Construction loans typically cover:

-

Up to 75% of the home construction costs

-

Up to 65% of the land purchase cost

That means you’ll need to bring at least 25–35% down, depending on whether you’re financing land and construction together.

If you already own the land, good news: its current appraised value can count toward your equity, reducing your cash requirements.

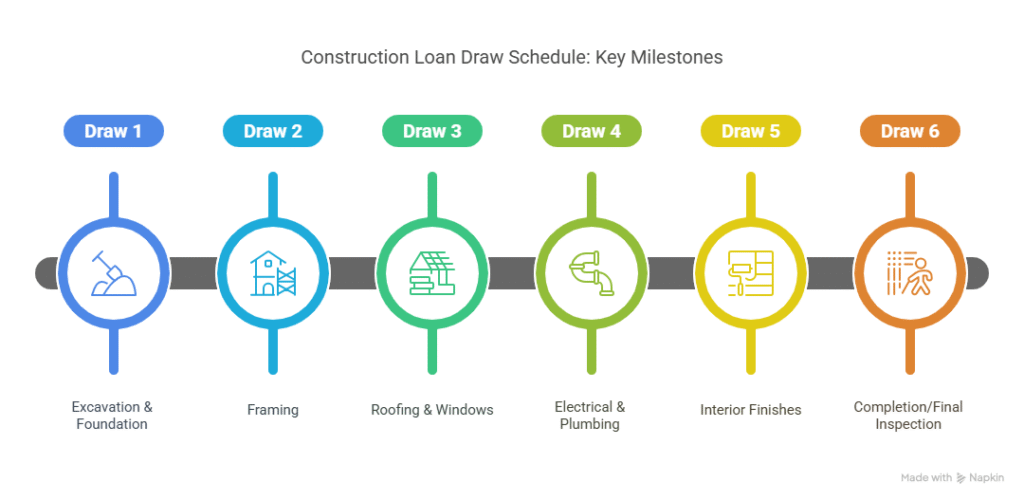

🪜 Draw Schedule: How Funds Are Released

Unlike a conventional mortgage that gives you the lump sum up front, construction loans release money based on a draw schedule.

Typical draw phases include:

-

Draw 1: Excavation & Foundation

-

Draw 2: Framing

-

Draw 3: Roofing & Windows

-

Draw 4: Electrical & Plumbing

-

Draw 5: Interior Finishes

-

Draw 6: Completion/Final Inspection

Each draw is inspected and approved before money is released. This protects the lender—and you—from paying for unfinished work or delays.

Bonus tip? Add a 10–15% contingency in your budget for overruns. They’re common.

💼 What’s the Interest Rate for Construction Loans?

Brace yourself—construction loan interest rates are generally higher than traditional mortgages. Why? Because lenders view unfinished homes as higher-risk assets.

Through lenders on WOWA.ca, you can expect:

-

Rates starting at 9.99%

-

Interest-only payments on the amount disbursed

-

Varying terms depending on your credit, lender, and location

While high, these rates are temporary. Once your home is complete, you can refinance into a traditional mortgage with much lower rates.

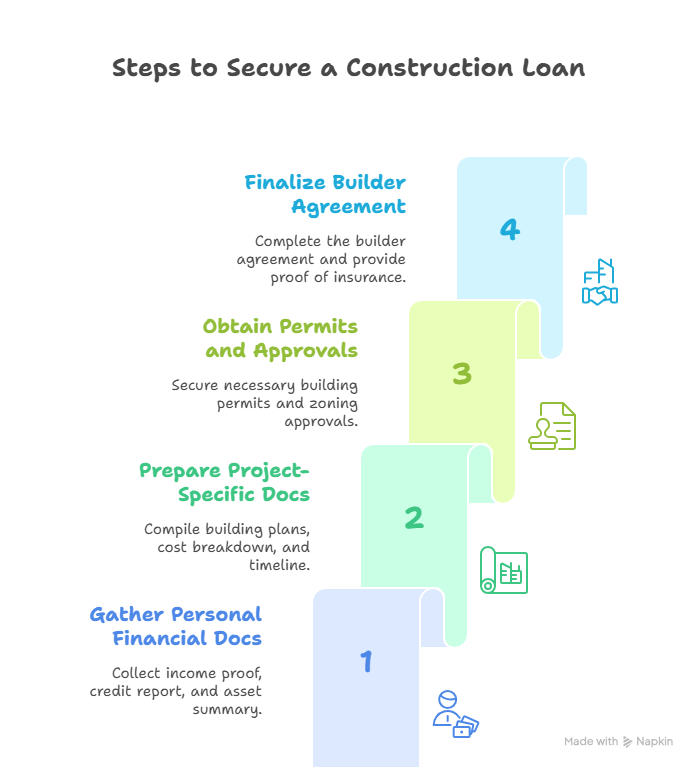

What Documents Do You Need to Apply?

No sugar-coating here—construction loans involve a lot of paperwork. Here’s what lenders typically want to see:

Personal Financial Docs:

-

Proof of income (T4s, NOAs, pay stubs)

-

Credit report

-

Assets and liabilities summary

Project-Specific Docs:

-

Detailed building plans

-

Cost breakdown

-

Construction timeline

-

Building permits and zoning approvals

-

Builder agreement and proof of insurance

The more organized you are, the smoother (and faster) your approval process will be.

🏠 Can You Finance Land + Construction Together?

Yes, you can. In fact, many construction loan packages in Canada are combined land + construction loans.

But keep in mind:

-

The land must be zoned for residential use

-

You’ll need to start building within a specific timeframe (usually 1–2 years)

-

Higher down payments may apply (30–50% for raw land without utilities)

Some lenders may also consider land you’ve already purchased, applying the value toward your construction loan equity.

🌲 Rural Builds and Off-Grid Homes? Yes, But…

Want to build your dream homestead in the woods of Muskoka or the mountains of BC? Construction loans for rural or off-grid homes do exist, but there are caveats:

-

You may need a larger down payment

-

Fewer lenders offer financing

-

Access to services (roads, hydro, water) is key

-

Permits and appraisals can take longer

WOWA.ca is a great place to find alternative lenders who specialize in these types of builds.

📈 What Happens After Construction?

Once your home is complete and you’ve got your certificate of occupancy, your construction loan ends. Now it’s time to refinance into a traditional mortgage.

This is usually a pre-planned step with the same lender, but in some cases, you’ll need to shop around or requalify. Here’s what to expect:

-

New mortgage term (15, 20, or 30 years)

-

Better interest rate

-

Lower monthly payments

-

One final closing process

Planning this step ahead of time ensures a smooth transition.

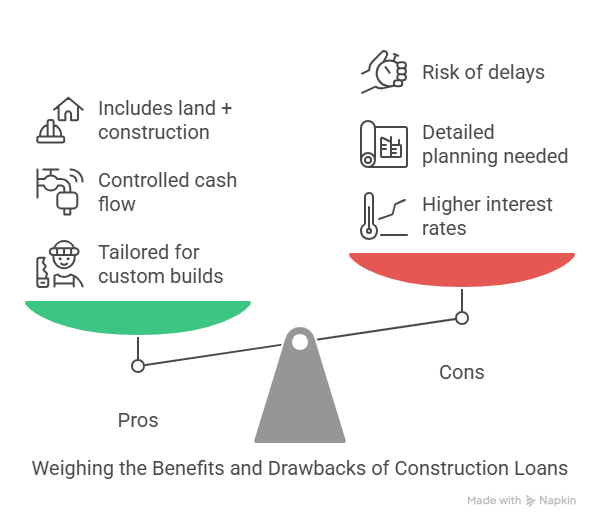

🧠 Pros and Cons of Construction Loans in Canada

Let’s break it down:

✅ Pros

-

Tailored for custom builds or major renovations

-

Funds released gradually = controlled cash flow

-

Can include land + construction

-

Interest-only during build

-

Equity in land can reduce down payment

❌ Cons

-

Higher interest rates

-

Requires detailed planning and paperwork

-

Risk of delays and cost overruns

-

Requires refinancing into a mortgage later

🛠️ Is a Construction Loan Right for You?

A construction loan isn’t for everyone. But if you’re:

-

Building a custom home

-

Planning a major reno or teardown

-

Buying land and building

-

Wanting control over design and cost

…then a construction loan might be your best path forward. Just remember—it’s not a set-it-and-forget-it solution. You’ll need to stay organized, hire the right builder, and keep the project on track.

WOWA.ca is an excellent launchpad to connect with trusted Canadian lenders who specialize in construction financing

🎯 Final Thoughts: Build Smart, Build Strong

Building a home is a big move—financially and emotionally. And while construction loans may seem daunting, with the right information, they become a powerful tool to bring your vision to life.

Take your time. Plan well. Budget carefully. And when in doubt? Let WOWA.ca be your co-pilot. With lender comparisons, calculators, and expert advice, it’s never been easier to get started.

FAQs

1. Can I build my own home without a licensed builder?

Some lenders do allow owner-builders, but it’s rare and involves stricter requirements. Expect to prove experience and provide a detailed construction plan.

2. What happens if my project goes over budget?

You’ll need to cover the difference out-of-pocket. Always plan a 10–15% contingency fund for unexpected costs.

3. Can I include appliances and landscaping in the loan?

Yes, basic appliances and standard landscaping can be included if they’re part of the initial budget. Luxury features (pools, saunas) usually aren’t covered.

4. Is there a penalty if construction takes longer than planned?

Delays can result in extra interest and possibly needing a loan extension. Stay in close communication with your builder and lender to avoid surprises.

5. Can I get pre-approved before I finalize my blueprints?

Yes! Many lenders will offer pre-approval based on estimates, then finalize once you submit full plans. This helps you shop for land with confidence.