Credit Score in Canada: What It Is, Why It Matters, and How to Improve It

Let’s talk about something that most people hear about but don’t fully understand your credit score. It’s like your financial reputation in three digits. Mysterious? Maybe. Important? Absolutely.

Whether you’re applying for a mortgage, leasing a car, or even renting an apartment, your credit score plays a big role. It’s like your adult report card and trust me, lenders are paying close attention.

In this guide, we’ll walk you through everything you need to know about credit scores in Canada. We’ll unpack what they are, how they’re calculated, and what steps you can take to boost yours, even if you’re starting from scratch or recovering from past mistakes.

What Is a Credit Score, Really?

Imagine you’re lending money to a friend. You’d probably ask yourself: “Will they pay me back?” That’s essentially what a credit score tells lenders.

In Canada, your credit score is a three-digit number ranging from 300 to 900, indicating how likely you are to repay borrowed money. The higher your score, the better you look in the eyes of banks, credit card companies, and landlords.

It’s not just a number it’s a snapshot of your financial trustworthiness.

Who Creates Your Credit Score in Canada?

Great question. There are two main credit bureaus in Canada that keep tabs on your financial activity:

-

Equifax

-

TransUnion

These guys gather information from lenders, utility companies, and even cellphone providers to create a detailed credit report — and from that, your credit score is born.

Each bureau might give you a slightly different score, depending on what data they have. But the key principles behind the score calculation are the same.

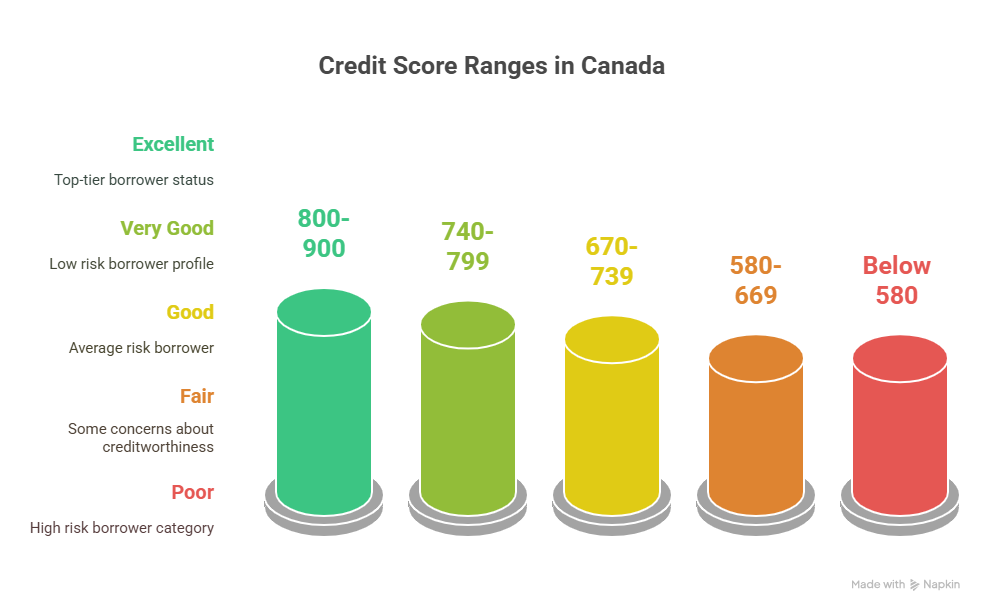

What’s Considered a Good Credit Score in Canada?

Here’s a quick breakdown:

| Score Range | Credit Rating | What It Means |

|---|---|---|

| 800 – 900 | Excellent | Top-tier borrower |

| 740 – 799 | Very Good | Low risk |

| 670 – 739 | Good | Average risk |

| 580 – 669 | Fair | Some concerns |

| Below 580 | Poor | High risk |

So, if your score is above 670, you’re doing pretty well. But if it’s below that, don’t panic — we’ll talk about how to improve it shortly.

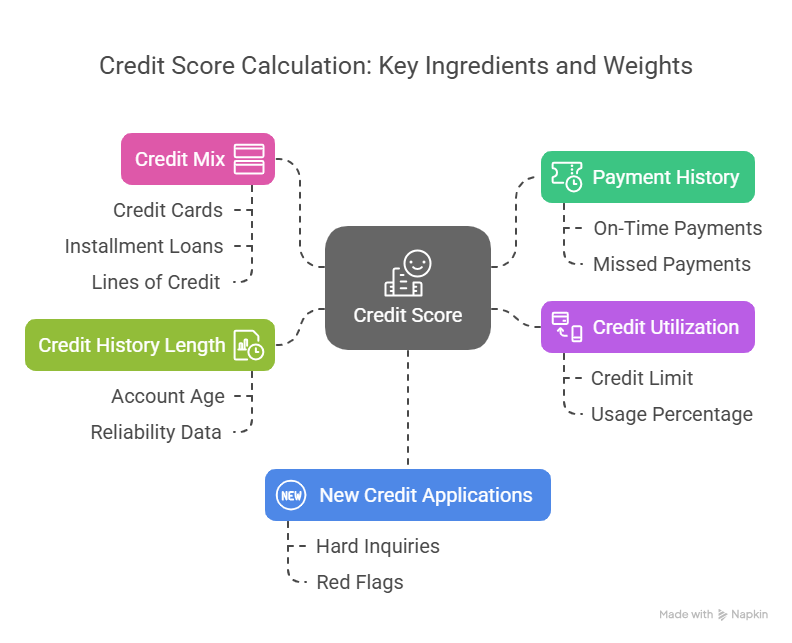

How Is Your Credit Score Calculated?

Think of your credit score as a soup made of five key ingredients. Each one has its own weight in the recipe:

1. Payment History (35%)

This is the big one. Have you paid your bills on time? Even one missed payment can drag your score down. This includes credit cards, loans, and even overdue utility bills sent to collections.

2. Credit Utilization (30%)

This refers to how much of your available credit you’re using. If you have a $10,000 limit and you’ve used $8,000, that’s 80% — and that’s not great. Experts recommend staying below 30%.

3. Credit History Length (15%)

How long have your accounts been open? The longer your track record, the more data lenders have to judge your reliability. It pays to keep that old credit card open — even if you don’t use it.

4. New Credit Applications (10%)

Applying for new credit creates a “hard inquiry,” which temporarily dings your score. Too many inquiries too quickly? That raises red flags.

5. Credit Mix (10%)

Credit cards, installment loans, lines of credit — having a healthy mix shows you can manage different types of debt responsibly.

Why Does Your Credit Score Matter?

You might be thinking, “I always pay cash. Why should I care about my credit score?”

Here’s the reality: your credit score affects way more than just borrowing.

When a Good Credit Score Comes in Handy:

-

Getting approved for a mortgage or rental

-

Securing low-interest rates on loans

-

Applying for a credit card with perks

-

Setting up utility or cellphone accounts

-

Landing some types of jobs or insurance policies

Basically, your score helps you save money and access opportunities. A bad score? That can cost you thousands in interest and fees over time.

How to Check Your Credit Score in Canada (for Free!)

Want to know your score? Good news — you don’t have to pay.

Two Ways to Check Your Credit Report and Score:

1. Through the Credit Bureaus:

-

Equifax Canada: Free report and paid score.

-

TransUnion Canada: Free report and score via registration.

2. Through Your Bank:

Many major banks (like RBC, BMO, and Scotiabank) now offer free credit score checks to clients through online banking.

3. Third-Party Apps:

Apps like Borrowell and Credit Karma provide free credit scores and helpful tools to track and improve your score.

Common Myths About Credit Scores

Let’s bust a few myths while we’re at it.

❌ Myth #1: Checking your score hurts it.

Not true. When you check your own score, it’s called a “soft inquiry” — and it doesn’t affect your score at all.

❌ Myth #2: Carrying a balance boosts your score.

Wrong again. It’s best to pay off your balance in full. Carrying debt just costs you interest and doesn’t help your score.

❌ Myth #3: You need to be in debt to build credit.

Nope. Using credit responsibly and paying it off regularly is the key not staying in debt.

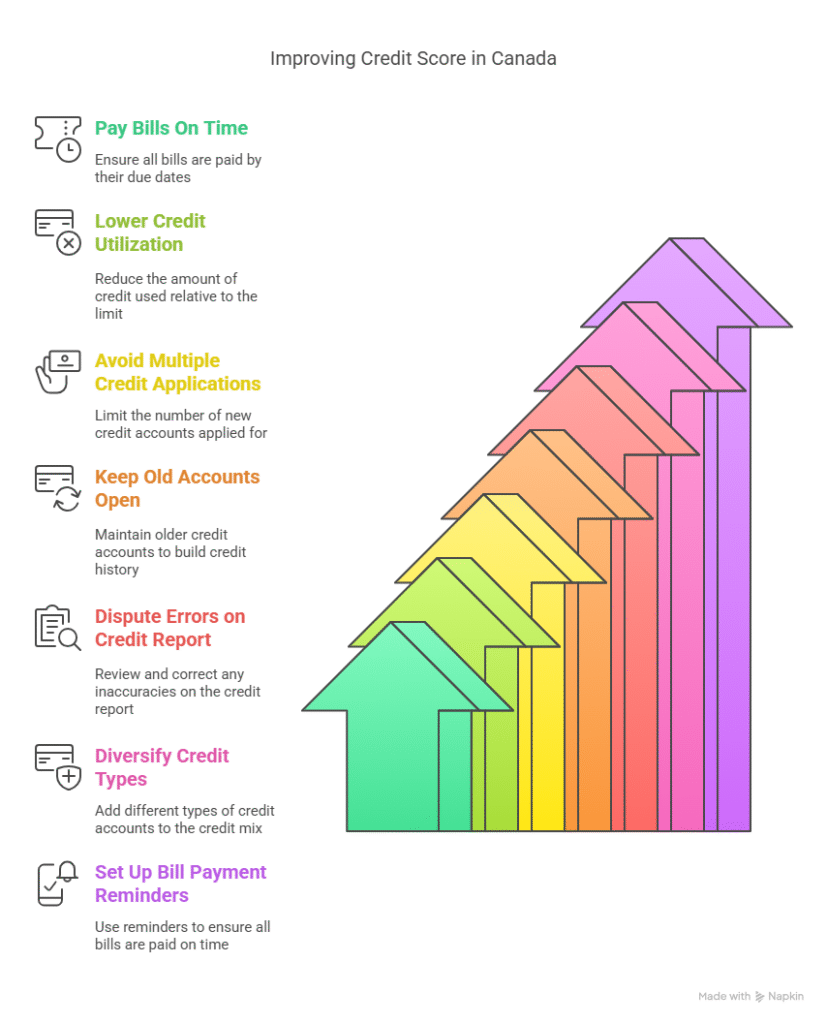

7 Actionable Ways to Improve Your Credit Score in Canada

Let’s get down to business. Here’s how to actually boost that number:

1. Always Pay On Time

This is non-negotiable. Set up reminders or autopay if you must — just never miss a due date.

2. Lower Your Credit Utilization

Pay down balances or ask for a credit limit increase (without increasing your spending!).

3. Avoid Applying for Multiple Credit Accounts

Every hard inquiry dings your score. Only apply when you truly need to.

4. Keep Old Accounts Open

Length of credit history matters. Don’t close that old card unless it has high fees.

5. Dispute Any Errors on Your Report

You’d be surprised how often reports contain mistakes. Review your report and dispute any inaccuracies.

6. Diversify Your Credit Types

If all you have is one credit card, consider adding a small personal loan or line of credit to boost your score mix.

7. Set Up Bill Payment Reminders

Whether it’s utilities or Netflix, keeping every account in good standing matters.

What If You Have No Credit History?

New to Canada? A student? Just never used credit before?

Here’s how to start building your credit score from scratch:

-

Get a secured credit card: You put down a deposit, and the card works like a regular credit card.

-

Apply for a retail or student credit card with a low limit.

-

Make small purchases and pay off your balance in full each month

Recovering from a Bad Credit Score

Been through bankruptcy, missed payments, or maxed out cards? It’s tough, but recovery is possible.

Steps to Rebuild:

-

Stick to the 7 tips above.

-

Set a realistic budget and cut unnecessary spending.

-

Work with a credit counselor for a recovery plan.

-

Consider a credit builder loan to re-establish positive payment history.

It takes time, but every on-time payment is a step forward.

How Long Does It Take to Improve Your Score?

There’s no one-size-fits-all answer. Some changes — like paying down a large balance — can improve your score within weeks. Others, like rebuilding from bad credit, may take 6–24 months or more.

Consistency is key. Think of it like going to the gym results don’t show overnight, but they add up over time.

Conclusion: Your Credit Score Is a Powerful Tool Use It Wisely

Here’s the bottom line: your credit score is more than just a number — it’s your ticket to financial freedom.

Whether you’re buying a home, starting a business, or just opening a phone plan, your score can open doors… or slam them shut.

So don’t ignore it. Track it, understand it, and work to improve it. You don’t have to be perfect — you just have to be consistent.

Your future self will thank you.

FAQs

How often should I check my credit score?

At least once every few months. It’s free, it won’t hurt your score, and it helps you catch errors early.

Can I get a mortgage with a poor credit score?

Yes, but it’ll likely come with higher interest rates or may require a co-signer or a larger down payment.

Does paying off a loan early hurt my credit score?

Not usually. It may reduce your credit mix slightly, but the positive impact of timely payments outweighs any negatives.

What’s the fastest way to improve a credit score?

Lower your credit utilization by paying down existing balances. That can boost your score in as little as 30 days.

Do cellphone or utility bills affect my credit score?

Yes, especially if you miss payments and the account is sent to collections. Always pay these on time.