Debt Consolidation in Canada: Which Path Should You Take?

Imagine juggling five credit card payments, a payday loan, and a line of credit, every month. It’s like trying to tame a bunch of wild horses with spaghetti reins. You feel pulled in every direction, right? That’s where debt consolidation comes in your financial lasso to bring everything under control.

If you’re a Canadian weighed down by multiple debts and wondering, “How do I simplify this madness without going broke?”, then you’re in the right place.

In this guide, we’re breaking down your top three options for debt consolidation in Canada:

-

The Government of Canada’s informational approach

-

The Credit Counselling Society (NoMoreDebts.org) — a well-known non-profit

-

And Credit Canada — another non-profit powerhouse

By the end, you’ll know exactly which path suits your financial journey.

What is Debt Consolidation, Really?

Debt consolidation is like spring cleaning for your finances. Instead of chasing down multiple bills, you roll them into a single, more manageable payment—usually with a lower interest rate and fewer headaches.

It can be done through:

-

A consolidation loan (typically from a bank)

-

A Debt Management Program (DMP) via a non-profit agency

-

Or using a line of credit like a HELOC

But not all debt consolidation methods are created equal—and neither are the providers.

Option #1: The Government of Canada’s Guidance

Let’s kick things off with the most neutral party—the Canadian government. They don’t offer loans or direct programs, but they do provide a ton of unbiased, straightforward advice through the Financial Consumer Agency of Canada (FCAC).

What You’ll Find on Canada.ca

-

Clear definitions of debt consolidation and related terms

-

Comparison tools for loans and interest rates

-

Budgeting calculators to map out your repayment journey

-

Credit check info so you can understand your score

Who’s It For?

If you’re the DIY type—someone who likes doing their homework before making a move—this site’s your best friend. It’s ideal for getting a lay of the land before committing to a plan or agency.

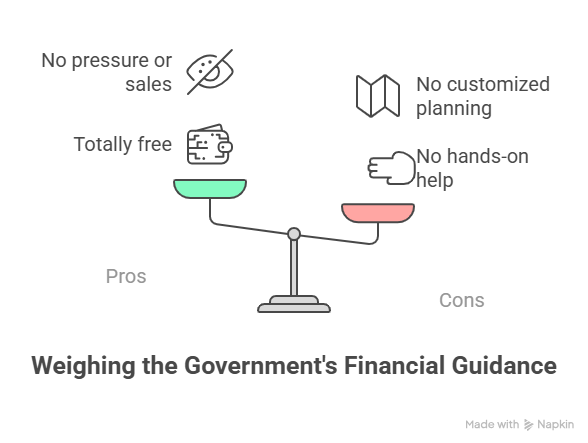

Pros:

-

Totally free (yay!)

-

No pressure or sales pitches

-

Ideal for budgeting and learning the ropes

Cons:

-

No hands-on help

-

No negotiation with creditors

-

No emotional support or customized planning

Bottom Line:

Think of the Government of Canada’s page as your financial compass—great for orientation, not navigation.

Option #2: Credit Counselling Society (NoMoreDebts.org)

If the government is your compass, then Credit Counselling Society (CCS) is like having a seasoned financial guide walk beside you.

They’re a non-profit agency helping Canadians since 1996 with everything from budgeting to Debt Management Programs (DMPs).

What They Offer

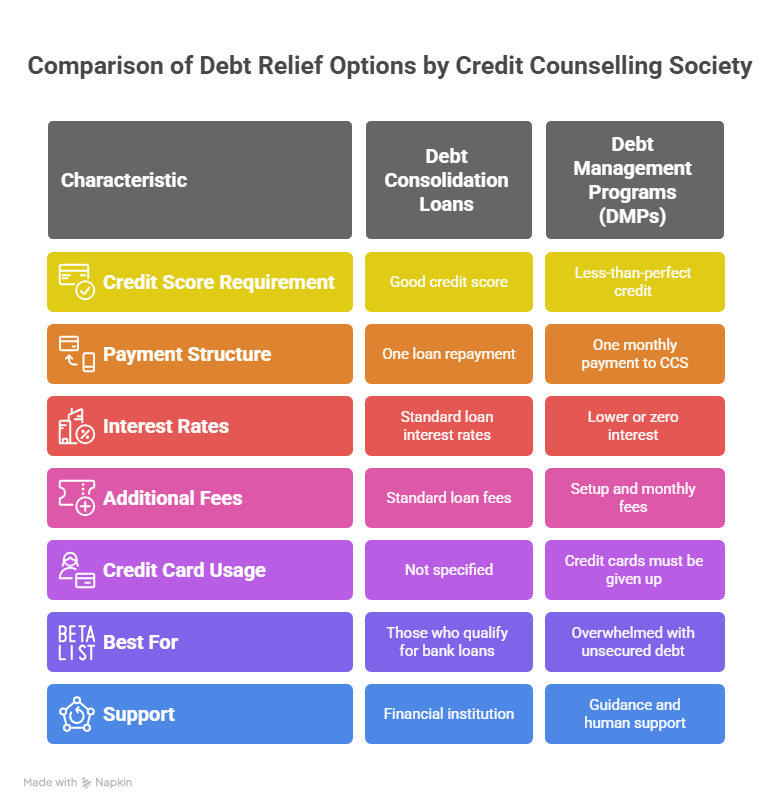

🏦 Debt Consolidation Loans

If your credit’s not too shabby, CCS can help you secure a loan from a bank or credit union to pay off your debts in one go. You then repay that one loan—easy peasy.

💼 Debt Management Programs (DMPs)

For those with less-than-perfect credit, a DMP is the golden ticket. You make one monthly payment to CCS, and they pay your creditors—often with lower or even zero interest.

🛠 Other Tools:

-

Free budgeting advice

-

Credit report reviews

-

Workshops and online tools

Pros:

-

Certified, experienced counsellors

-

Negotiates with creditors for better terms

-

Multiple debt relief options

Cons:

-

DMP fees: $50–$75 setup + monthly fees (max $75)

-

Affects your credit short-term

-

Must give up your credit cards during the program

Who’s It For?

You if:

-

You’re overwhelmed with unsecured debt

-

You don’t qualify for bank loans

-

You want guidance and human support

Bottom Line:

CCS is like your financial therapist—they listen, understand, and help you build a recovery plan.

Option #3: Credit Canada

Now let’s talk about Credit Canada, a fellow non-profit that’s been around even longer—since 1966.

Their star player? The Debt Consolidation Program (DCP).

What Makes Them Stand Out

💡 No Loans Needed

The DCP works a lot like CCS’s DMP. You make one monthly payment to Credit Canada. They distribute it to your creditors after negotiating lower interest (sometimes down to zero).

🤐 Silencing Collection Calls

Once you enroll, collection agencies have to stop calling you. That alone is a stress-lifter.

💳 No Credit Check Needed

Unlike bank loans, you don’t need a stellar credit score to qualify. Credit Canada focuses on your income and willingness to follow the program.

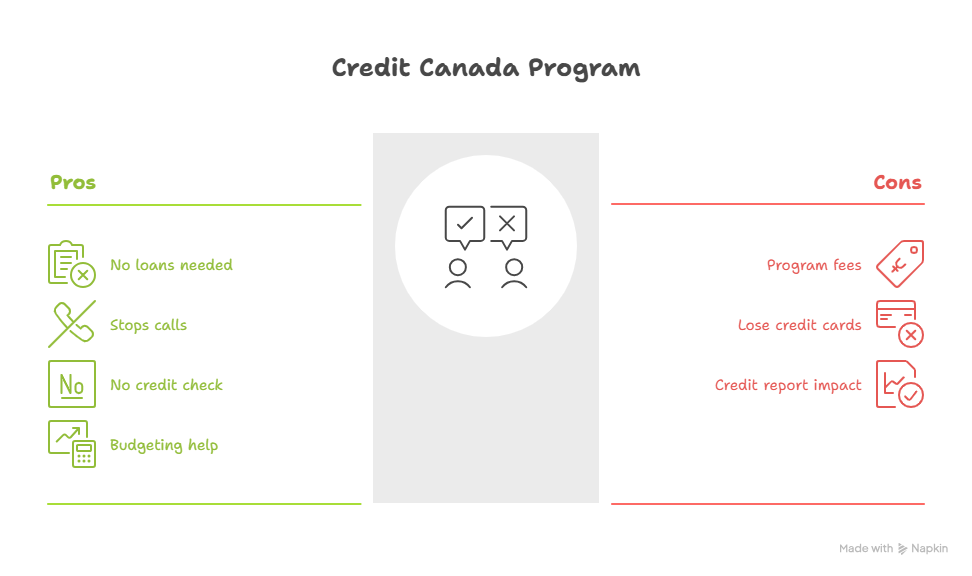

Pros:

-

No loans or collateral required

-

Stops harassing phone calls

-

No credit score required to qualify

-

Budgeting help and free consultations

Cons:

-

Program fees (setup + 10% monthly)

-

You’ll lose access to your credit cards

-

It may show up on your credit report

Who’s It For?

-

Folks with bad credit or no loan options

-

Anyone dodging collection calls

-

Those who want a clear, step-by-step exit from debt

Bottom Line:

Credit Canada is like the financial firefighter—they show up when things are burning and help you put out the flames.

How Do They All Compare?

Here’s a quick-glance chart to see how each stacks up:

| Feature | Gov. of Canada | Credit Counselling Society | Credit Canada |

|---|---|---|---|

| Direct Debt Relief | ❌ No | ✅ Yes | ✅ Yes |

| Loan Option | ❌ No | ✅ If eligible | ❌ No |

| Debt Management Program | ❌ No | ✅ Yes | ✅ Yes (DCP) |

| Free Budget Tools | ✅ Yes | ✅ Yes | ✅ Yes |

| Fees | ❌ None | ⚠️ Setup + Monthly Fees | ⚠️ Setup + Monthly Fees |

| Stops Collection Calls | ❌ No | ✅ Yes | ✅ Yes |

| Credit Impact | ❌ None | ⚠️ Short-term | ⚠️ Short-term |

| Human Guidance | ❌ No | ✅ Certified Counsellors | ✅ Certified Counsellors |

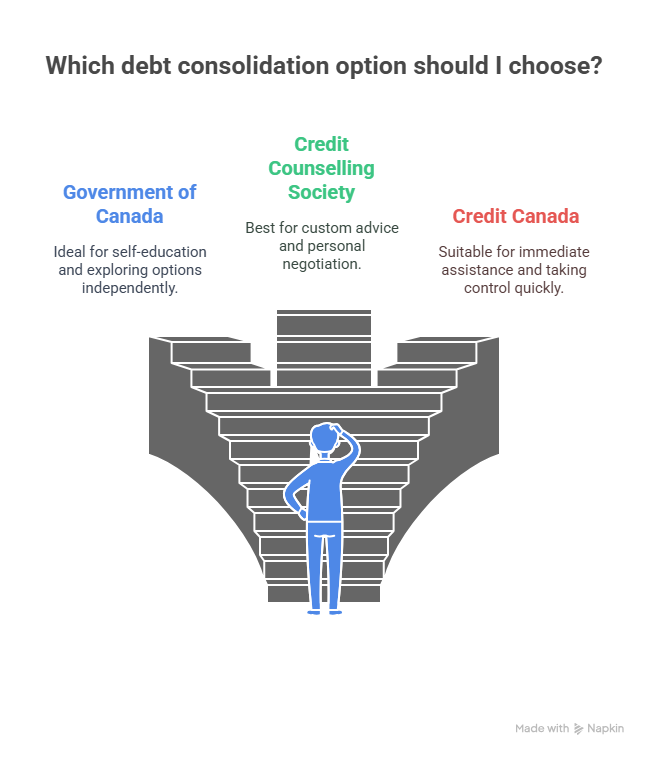

So, Which One’s Right For You?

Here’s a quick test:

-

Do you want to educate yourself first and explore options solo? 👉 Go with the Government of Canada.

-

Need custom advice, creditor negotiations, and a personal touch? 👉 Try the Credit Counselling Society.

-

Overwhelmed, under pressure, and need someone to take the wheel ASAP? 👉 Ring up Credit Canada.

Conclusion: Consolidate Your Way to Calm

Debt consolidation isn’t just about math—it’s about mental peace. It’s about feeling like you’re finally steering your ship instead of bailing water nonstop.

Each of these options—government guidance, CCS, and Credit Canada—has its unique strengths. Pick the one that matches your needs, and you’ll be taking a smart step toward a life with fewer bills, less stress, and more control.

FAQs About Debt Consolidation in Canada

Will debt consolidation hurt my credit score?

Short-term? It might. Long-term? It often improves your credit by reducing debt and ensuring on-time payments. Programs like DMPs are noted on your credit report but look way better than missed payments or collections.

Can I still use my credit cards during a debt consolidation program?

Nope. Most non-profits like CCS and Credit Canada require you to stop using credit cards to prevent slipping back into debt.

What types of debt can I consolidate?

Unsecured debts only—think credit cards, payday loans, and personal loans. Mortgages, car loans, and student loans are usually not eligible.

How long does a debt consolidation program take to complete?

Most DMPs or DCPs run between 2 to 5 years. It depends on your total debt and what you can afford monthly.

Can I consolidate debt if I have bad credit?

Absolutely. That’s where agencies like Credit Canada shine. You don’t need good credit—just reliable income and a commitment to stick with the plan.