Fixed vs. Variable Rate Mortgages in 2025: Which One’s Right for You?

Ready to Buy a Home or Refinance? Here’s the Mortgage Showdown You Need

So, you’re standing on the edge of a big financial leap—buying a home or refinancing your current one. Congratulations! But before you dive in, there’s this one massive question hanging in the air:

Should you go with a fixed-rate or a variable-rate mortgage?

It’s kind of like choosing between Spotify Premium and the free version. One offers consistency, the other flexibility, with some surprises along the way. If you’re confused, you’re not alone. This guide breaks it all down in plain English, with real insight, a human voice, and practical advice for 2025.

Let’s demystify the mortgage maze, together.

Fixed-Rate Mortgages: Set It and Forget It

What is a Fixed-Rate Mortgage?

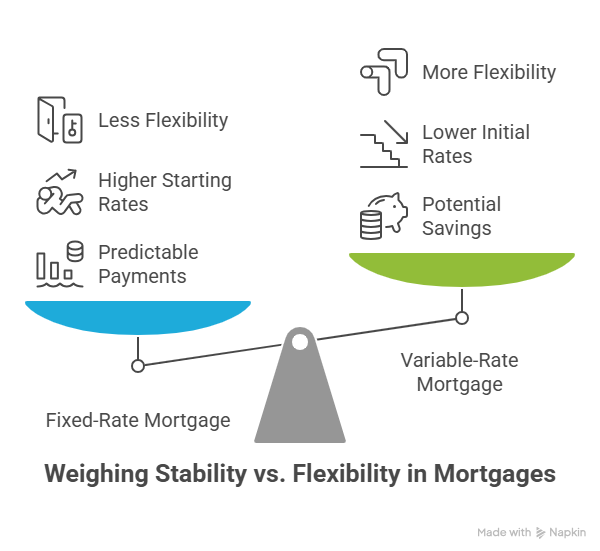

A fixed-rate mortgage means your interest rate—and your monthly payment—stays the same for the entire loan term. Whether it’s a 5-year, 10-year, or 25-year mortgage, nothing changes. It’s the financial equivalent of cruise control.

Why People Love It

-

Predictability is King: Your payments never change. No nasty surprises.

-

Great for Budgeting: Know exactly what you owe each month.

-

Stress-Free Stability: Rising interest rates? Doesn’t affect you one bit.

Downsides You Should Know

-

Higher Starting Rates: Fixed-rate mortgages often start higher than variable ones.

-

Less Flexibility: If interest rates drop, you’re stuck—unless you refinance (which might cost you in penalties).

-

You Might Miss Out on Savings: If the market shifts in your favor, you won’t benefit unless you break your mortgage early.

💡 Fixed rates are perfect for people who love stability, hate surprises, and plan to stay in their homes for a while.

Variable-Rate Mortgages: Go With the Flow (If You Dare)

What is a Variable-Rate Mortgage?

A variable-rate mortgage means your interest rate (and potentially your payment) changes based on the market. It’s usually tied to your lender’s prime rate, which moves up or down based on the Bank of Canada’s overnight rate.

Perks You Might Enjoy

-

Lower Initial Rates: You’ll likely start with a lower rate than fixed mortgages.

-

You Can Save Big—If Rates Stay Low: You ride the wave and potentially save thousands.

-

Flexible Terms: Variable mortgages are easier to break or switch.

But There’s Risk, Too

-

Unpredictable Payments: If rates rise, so do your payments.

-

Harder to Budget: Monthly fluctuations can mess with your planning.

-

Not for the Faint of Heart: You’ll need some financial cushion for bad months.

💡 Variable rates are ideal for those who can roll with financial punches and want to gamble (smartly) on interest trends.

Fixed vs. Variable: A Side-by-Side Mortgage Smackdown

| Feature | Fixed-Rate Mortgage | Variable-Rate Mortgage |

|---|---|---|

| Interest Rate | Locked in and stable | Changes based on prime rate |

| Monthly Payments | Always the same | Can go up or down |

| Risk Level | Low risk, high stability | Higher risk, more flexibility |

| Cost Savings | Predictable, but usually costlier | Potential for big savings (or losses) |

| Best For | Long-term homeowners, budgeters | Flexible buyers, short-term planners |

What’s Happening in the Mortgage Market in 2025?

Ah yes, the burning question—what’s the market doing now?

📌 Fixed Mortgage Rates in 2025

Fixed-rate mortgages have risen above 4%, mostly due to increases in bond yields and market uncertainty.

📌 Variable Mortgage Rates in 2025

The Bank of Canada has kept its overnight rate at 2.75%, so variable rates have stayed relatively stable (for now).

📊 According to NerdWallet and Ratehub, many Canadians are now re-evaluating their mortgage type as rate fluctuations continue.

So… How Do You Choose the Right One?

This decision isn’t just about interest rates—it’s about YOU. Your goals. Your lifestyle. Your risk tolerance.

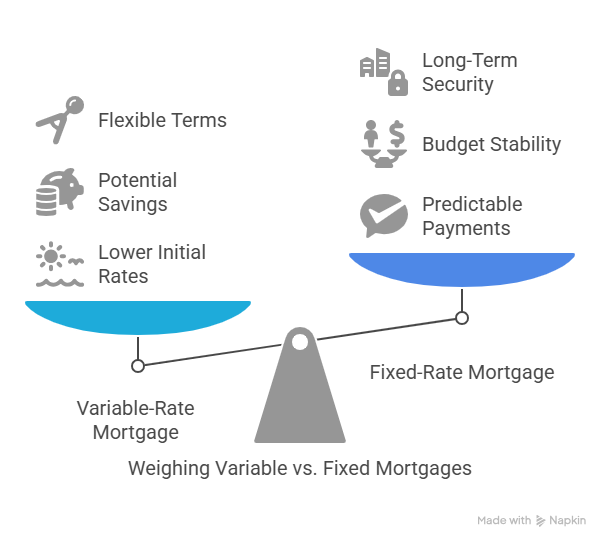

✅ Go Fixed If:

-

You’re super into planning and hate surprises.

-

You’re in your “forever home.”

-

Rates are expected to rise (hint: they probably are).

-

You sleep better knowing exactly what your bill is every month.

✅ Go Variable If:

-

You’re financially flexible and can handle fluctuations.

-

You’re planning to move or refinance in a few years.

-

You want to chase savings—without freaking out if they don’t come.

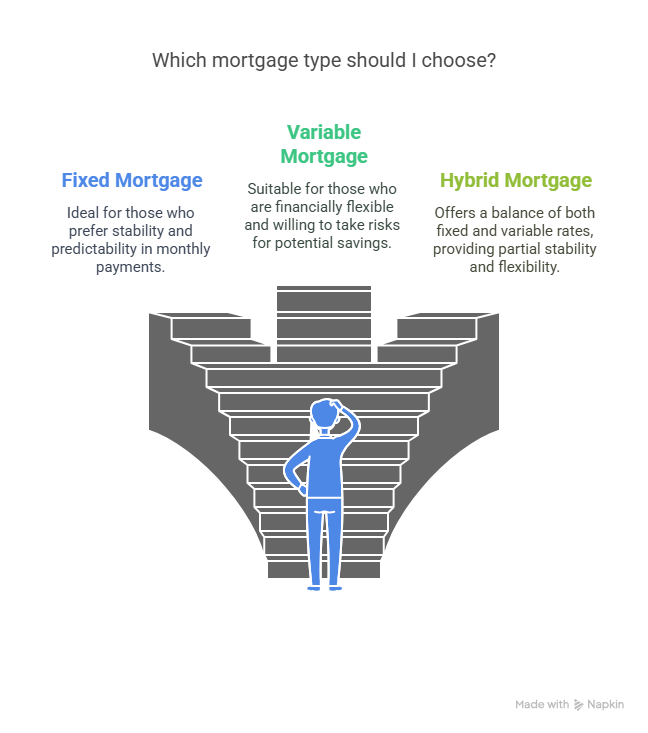

🎯 Still unsure? Some mortgage brokers offer hybrid mortgages—a mix of fixed and variable. It’s like dipping your toe in both pools.

Can You Switch from Variable to Fixed Mid-Term?

Yes! And many Canadians did exactly that during recent interest rate spikes.

Here’s how:

-

Talk to your lender or broker. Most lenders allow you to lock into a fixed rate at any time.

-

Watch for timing. Switch when fixed rates are still reasonable.

-

Beware of penalties. Breaking a mortgage early can cost thousands—ask upfront.

💬 Pro Tip: Ask your broker to run a “break-even analysis” to see if switching saves you money in the long run.

Real Talk: Case Studies That Bring It Home

🏡 Anna from Toronto

Chose a 5-year fixed mortgage in 2020. Rates went up in 2022, and she felt like a genius. Her payments stayed the same, while her friends in variable mortgages saw theirs rise 40%.

🏡 Jake from Vancouver

Went variable in 2021, snagged ultra-low rates, and refinanced in 2023 to fixed when rates started climbing. He saved $8,000 in two years.

Moral of the story? Your best mortgage choice often comes down to timing and tolerance.

Final Thoughts: What’s the Best Move in 2025?

There’s no one-size-fits-all answer. But here’s the bottom line:

-

Choose fixed if you want peace of mind and plan to stay put.

-

Choose variable if you’re OK with some uncertainty and want potential savings.

The mortgage world can feel like a high-stakes game. But with the right knowledge—and a solid plan—you’ll come out a winner.

FAQs!

Is it cheaper to go variable in 2025?

Not always. Variable rates start lower, but they can rise. It depends on how long you stay in the mortgage and how rates behave.

Can I switch from variable to fixed anytime?

Yes, most lenders allow it—usually without penalty. Check the details of your mortgage agreement.

What if I break a fixed-rate mortgage early?

You’ll likely pay a prepayment penalty, which can be thousands of dollars. Always ask before signing.

Are there any hybrid mortgages in Canada?

Yes! Some mortgages offer fixed for a few years, then convert to variable. It’s a middle-ground option.

How do I know what’s right for me?

Talk to a mortgage broker or financial advisor. They can run the numbers and match your risk profile to the best option.