Ontario Mortgage Rates in 2025: Everything You Need to Know Before You Lock In

Buying a home in Ontario this year? Whether you’re a first-timer or a seasoned real estate pro, getting the best mortgage rate is like finding the golden snitch in a game of Quidditch—it’s a total game-changer. But with so many lenders, rates, and terms out there, it’s easy to feel like you’re drowning in a sea of percentages and financial jargon.

Don’t worry, I’ve got your back. In this guide, we’ll break down the mortgage rate scene in Ontario in 2025 . We’ll compare the big players, look at fixed vs variable rates, and show you how to snag the lowest possible rate without losing your mind.

What Are Mortgage Rates, Anyway?

Let’s start with the basics. A mortgage rate is the interest your lender charges you to borrow money for a home. It’s how they make their money—like rent, but for cash.

There are two main types:

-

Fixed Rate: Stays the same for your term (e.g., 5 years). Think of it like a cruise control.

-

Variable Rate: Changes as the prime rate moves. It can be cheaper at first, but riskier in the long run.

Your rate is influenced by:

-

The Bank of Canada’s benchmark rate

-

The bond market (for fixed rates)

-

Your credit score, income, down payment, and debt load

Ontario Mortgage Rate Snapshot: April 2025 (Please note: rates are subject to fluctuation.)

Let’s get into the numbers. Here’s what major platforms are offering as of April 2025:

Ratehub.ca

-

5-Year Fixed: 3.74%

-

3-Year Fixed: 3.79% (Meridian CU)

-

4-Year Fixed: 4.19% (Desjardins)

-

2-Year Fixed: 4.24%

-

7-Year Fixed: 4.49%

WOWA.ca

-

1-Year Fixed (Insured): 4.79% (Frank Mortgage)

-

2-Year Fixed (Insured): 4.19%

-

3-Year Fixed (Insured): 3.74%

-

4-Year Fixed (Insured): 4.29%

-

5-Year Fixed (Insured): 3.64% (nesto)

-

5-Year Variable (Insured): 3.89%

True North Mortgage

-

Starting rates as low as 2.99%

-

On average, their rates are 0.18% lower than big banks

-

Lowest Rate Guarantee or they give you $500

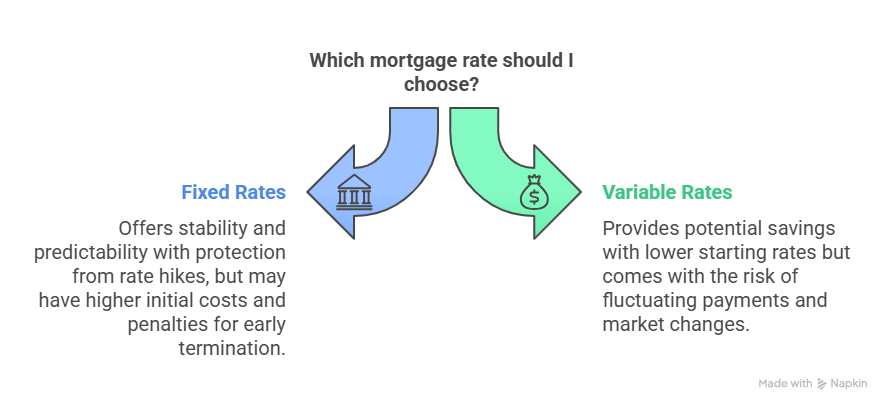

Fixed vs Variable Rates: Which One Should You Choose?

Here’s where the decision gets spicy. Let’s break it down:

Fixed Rates: Stability is the Name of the Game

If you want to set it and forget it, a fixed rate might be your best friend. You lock in a rate, and that’s what you pay, rain or shine.

-

Pros: Predictable payments, protection from rate hikes

-

Cons: Usually a bit higher than variable, penalty fees if you break your mortgage early

Variable Rates: Roll the Dice, Ride the Waves

If you don’t mind a bit of risk (and want to save some $$), variable could be the move. Rates start lower, but can rise if the market shifts.

-

Pros: Lower starting rate, historically cheaper over the long term

-

Cons: Fluctuating payments, risk of rate increases

Pro tip? If rates are high and expected to drop, variable could win. If rates are low and expected to rise, go fixed.

Who Offers the Best Mortgage Rates in Ontario?

Here’s a quick rundown of some top players.

1. Ratehub.ca

A comparison site that aggregates rates from banks, brokers, and credit unions. They offer a clean interface and solid calculators.

Why Use It: Easy comparison, good tools, updates regularly

2. WOWA.ca

Another comparison site, but with more data-driven features. They include bond yield charts and more lender-specific info.

Why Use It: Deep dive analysis, updated frequently, rate trend graphs

3. True North Mortgage

A hybrid lender-broker. They undercut the banks and promise to beat any competitor.

Why Use It: Direct access to brokers, lowest rate guarantees, strong reputation

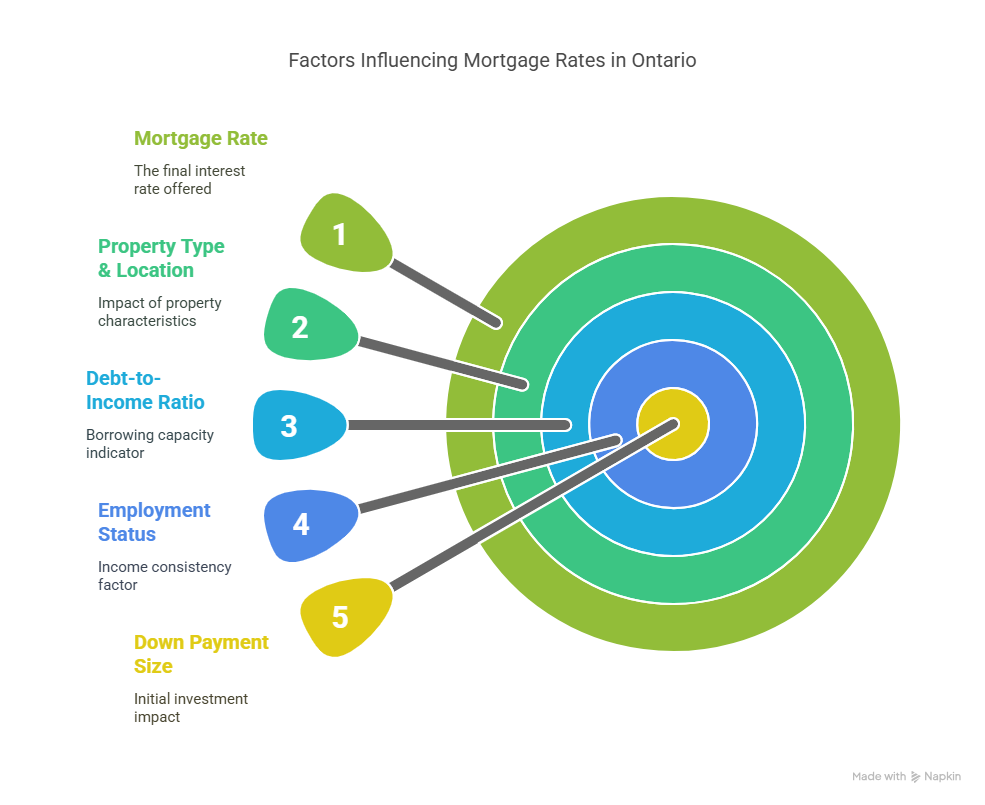

What Affects Your Mortgage Rate in Ontario?

Not everyone gets the advertised rate. Here’s what lenders look at:

-

Credit Score: Higher = better rate

-

Down Payment Size: 20% or more can unlock better deals

-

Employment Status: Consistent income wins

-

Debt-to-Income Ratio: The less you owe, the more you can borrow

-

Property Type & Location: Condos vs detached homes, urban vs rural

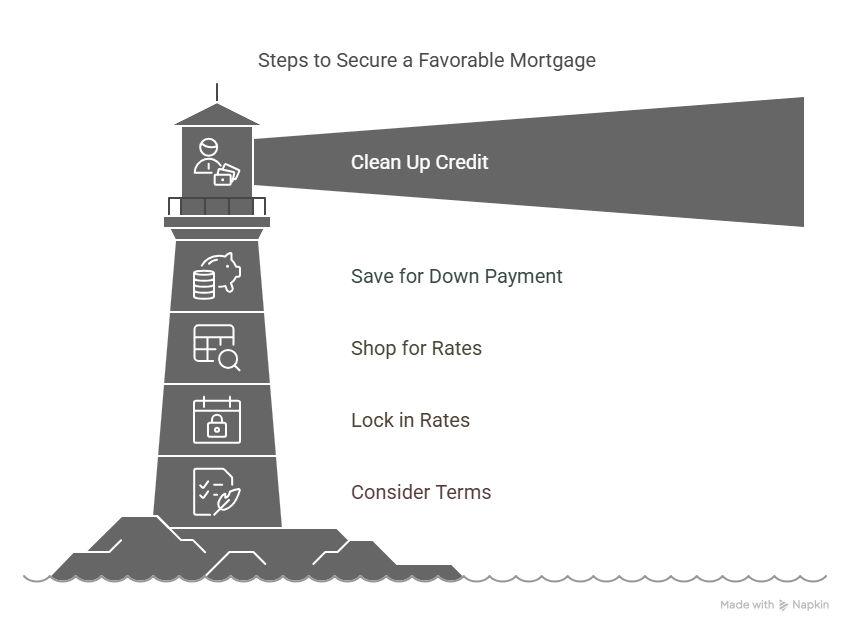

How to Score the Best Mortgage Rate

1. Clean Up Your Credit

Pay off credit cards, close unused accounts, and dispute any errors on your report.

2. Save a Bigger Down Payment

It shows lenders you’re less risky. Plus, it reduces your mortgage insurance costs.

3. Shop Around

Use comparison sites like Ratehub and WOWA. Talk to brokers. Ask your bank. Get quotes from at least 3 places.

4. Lock in at the Right Time

Rates can change weekly. If you see a good one, lock it in for 90-120 days.

5. Consider Portability and Penalties

Low rate isn’t everything. Check if the mortgage is portable and what it costs to break early.

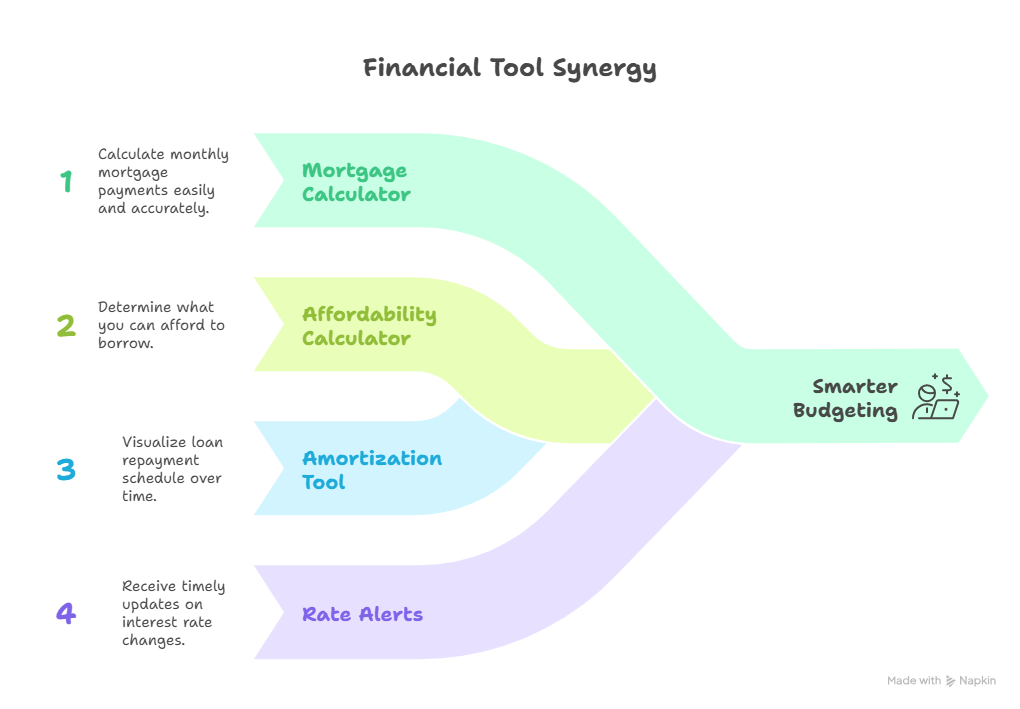

Tools You Should Definitely Use

-

Mortgage Payment Calculator (Ratehub / WOWA)

-

Affordability Calculator

-

Amortization Schedule Tool

-

Rate Alerts via email or app

These tools make life easier and help you budget smarter

Should You Get Pre-Approved First?

Absolutely. Pre-approval shows you how much home you can afford and locks in a rate for 120 days. It’s like window shopping with a gift card already in hand.

When Will Rates Go Up or Down?

Nobody has a crystal ball, but here’s what experts are saying:

-

Inflation is cooling – good news for potential rate drops.

-

The Bank of Canada may cut rates later in 2025 if the economy slows.

Keep an eye on bond yields and BoC announcements. Or, better yet, set up alerts.

Conclusion: Mortgage Rates Don’t Have to Be Scary

Whew, that was a lot. But you made it!

The Ontario mortgage market in 2025 is competitive, dynamic, and full of opportunity—if you know where to look. The key is preparation. Check your credit, save a down payment, get pre-approved, and shop around like you’re buying a used car from a dealership that knows you know the real price.

Remember: The lowest rate isn’t always the best deal. Look at the terms, flexibility, and your future plans.

So go out there and lock in that golden rate. Your future self (and your wallet) will thank you.

FAQ

1. Are online mortgage rates in Ontario accurate?

Mostly, yes. But they often assume ideal borrower conditions. Your actual rate may vary depending on your credit and income.

2. Can I negotiate a lower mortgage rate in Ontario?

Absolutely. Don’t be shy—use other quotes as leverage, especially with brokers.

3. What is the best mortgage term in 2025?

The 5-year fixed is still the most popular, but 2- and 3-year terms are gaining traction due to market uncertainty.

4. Is it better to go through a broker or a bank?

Brokers often have access to better deals and more flexibility, but banks may offer perks if you have a relationship.

5. Should I wait to buy a home if rates are expected to drop?

It depends. If you’re ready financially and find a home you love, go for it. You can always refinance later if rates drop significantly.