Second mortgage in your future? Make smart moves with this 2025 guide.

Thinking of tapping into your home’s equity but unsure where to start? Welcome to the world of second mortgages — a financial tool that can be a game-changer when used right… or a costly misstep if misunderstood.

Let’s unpack everything you need to know, without the jargon. Whether you’re looking to consolidate debt, renovate your kitchen, or fund a big life change, this guide is your go-to source on second mortgages in Canada.

What Exactly Is a Second Mortgage?

Think of your home like a pie. Your first mortgage? That’s the biggest slice. A second mortgage is like grabbing another slice — but it comes after the first, and with slightly different rules.

In plain terms, a second mortgage is a loan secured against the value of your home, just like your first mortgage. But because it’s second in line if things go sideways, lenders charge higher interest rates.

Here’s the kicker: You still own your house. But if you don’t pay back the second mortgage, the lender could force a sale to recoup their money — only after the first mortgage is paid off.

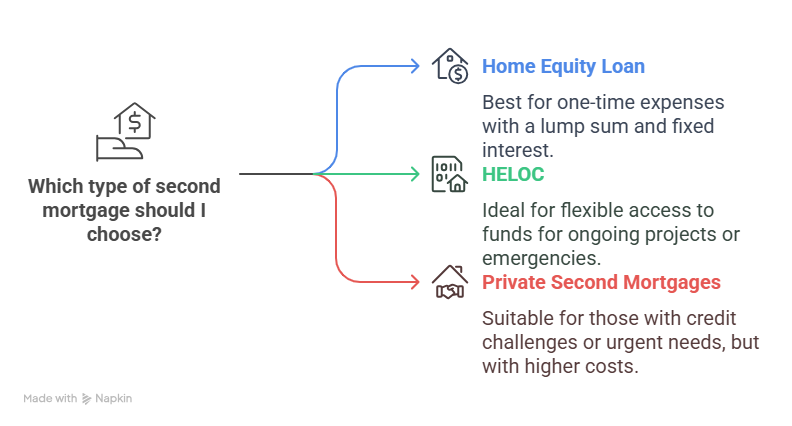

Types of Second Mortgages

1. Home Equity Loan

This is the straightforward option: you get a lump sum up front, and pay it back with interest over time. Great for one-time expenses like renovations or tuition.

2. HELOC (Home Equity Line of Credit)

More flexible. You get access to a credit line based on your home’s value. Take what you need, when you need it. Perfect for emergency funds or phased renovation projects.

3. Private Second Mortgages

Can’t qualify with a bank? Private lenders are an option — especially for borrowers with bad credit, non-traditional income, or urgent timelines. Just be ready for higher fees and rates.

Why Consider a Second Mortgage?

Good question! Here are some of the most common reasons Canadians take out second mortgages:

-

Debt consolidation: Combine high-interest debts (like credit cards) into one lower-interest mortgage payment.

-

Home renovations: Upgrade your space without draining your savings.

-

Tuition or education: Help your kids — or yourself — pay for school.

-

Business investment: Use your equity to fund a new venture.

-

Emergency expenses: Life happens. Sometimes, fast cash is necessary.

How Much Can You Borrow With a Second Mortgage?

This depends on your home’s equity — the difference between what your home is worth and what you still owe on it.

Lenders typically allow you to borrow up to 80% of your home’s appraised value, minus your existing mortgage balance.

Example:

-

Home value: $800,000

-

Mortgage owed: $500,000

-

Max borrowing (80% of value): $640,000

-

Available equity: $640,000 – $500,000 = $140,000

You may not get the full $140K depending on the lender, your credit, and other risk factors.

Interest Rates and Terms

Second mortgage interest rates vary, but they’re almost always higher than your first mortgage. Why? Because second mortgages are riskier for lenders.

Typical terms:

-

Interest rates: 7%–15% (or more for private lenders)

-

Loan terms: 1 to 5 years

-

Amortization: May be interest-only or include principal

Bank-issued HELOCs often have lower rates than private second mortgages, but they require better credit and more documentation.

Second Mortgage vs. HELOC: What’s the Real Difference?

Let’s simplify this:

| Feature | Second Mortgage | HELOC |

|---|---|---|

| Type | Lump-sum loan | Revolving line of credit |

| Interest Rate | Usually fixed, higher | Usually variable, lower |

| Repayment | Set payments | Flexible withdrawals & payments |

| Use Case | One-time big expenses | Ongoing or unpredictable needs |

Both options use your home as collateral — but how and when you repay is what makes all the difference.

What Does It Cost to Get a Second Mortgage?

Beyond interest rates, you’ll run into several fees:

-

Appraisal fee: $300–$500 to assess home value

-

Legal fees: $500–$1,500

-

Broker fees: 1%–2% (more for private lenders)

-

Lender fees: Sometimes 1%–3%

Pro Tip: Always ask for a detailed breakdown before signing anything.

Who Qualifies for a Second Mortgage?

Lenders look at:

-

Home equity (you need at least 20%)

-

Credit score

-

Income and employment status

-

Debt-to-income ratio

-

Purpose of the loan

If you’re applying through a bank like TD, you’ll need good credit and proof of income. Private lenders are more lenient but come with higher rates and more fees.

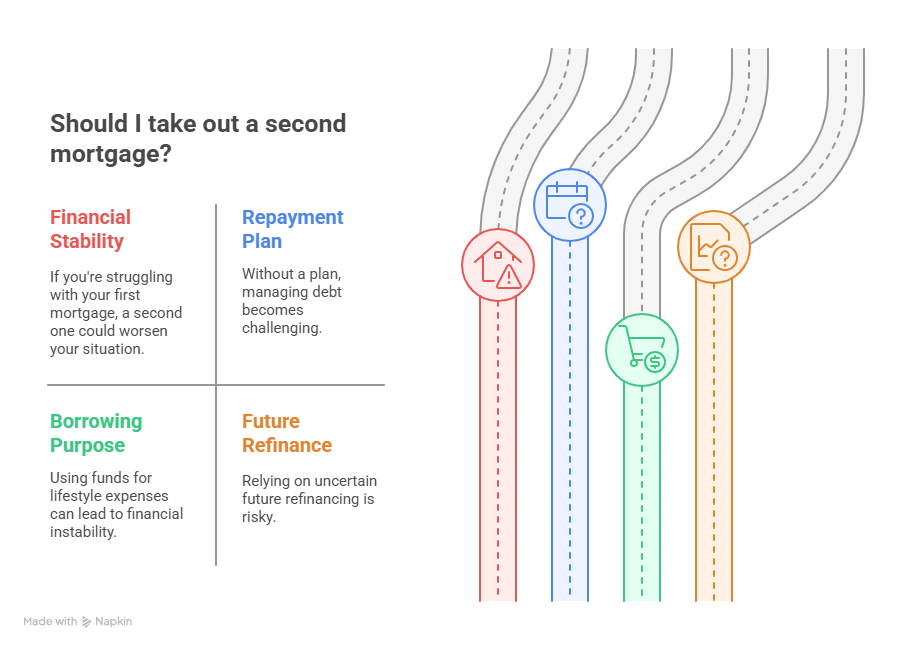

Risks to Be Aware Of

Every financial tool has its dark side. Second mortgages can be incredibly helpful — but only if you plan well.

Here are a few red flags:

-

You’re already struggling to pay your first mortgage

-

You don’t have a repayment plan

-

You’re borrowing for lifestyle expenses

-

You’re relying on a future refinance that may not happen

Bottom line: Borrowing against your home is serious business. Treat it like a business decision, not an emotional one.

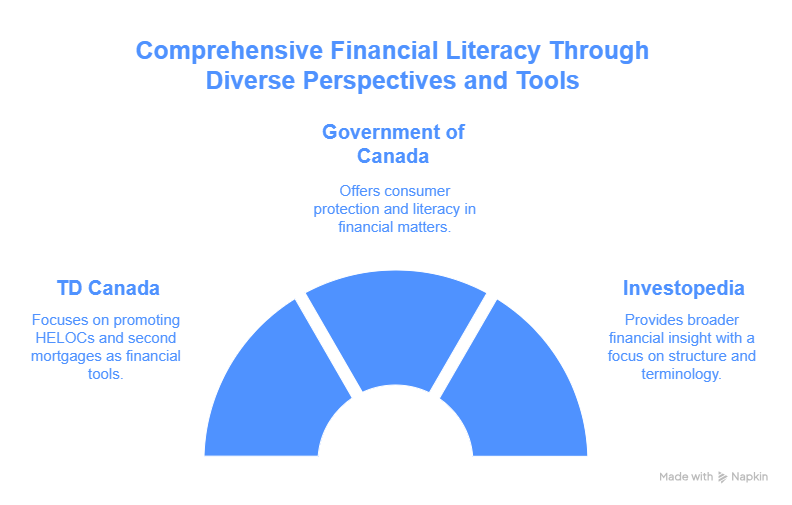

What Makes TD, Canada.ca, and Investopedia Different?

TD Canada

-

Focuses on promoting HELOCs and second mortgages as financial tools

-

Explains their internal lending criteria and how to apply

Government of Canada (FCAC)

-

Offers consumer protection and literacy

-

Encourages comparing lenders and understanding risks

-

Explains legal and regulatory obligations

Investopedia

-

Offers broader financial insight (some U.S.-centric language)

-

Focuses on structure, pros/cons, and technical terminology

Use all three together for a well-rounded view.

Best Practices Before You Sign

Want to avoid costly mistakes? Follow these:

-

Get a recent home appraisal – Know your equity.

-

Compare lenders – Don’t just go with the first offer.

-

Work with a licensed broker – Especially if using a private lender.

-

Understand the full cost – Ask for all fees upfront.

-

Plan your exit strategy – Will you refinance or sell in a few years?

Conclusion: Is a Second Mortgage Right for You?

Second mortgages can unlock serious potential — but only if they’re part of a smart financial plan. Whether you go through a major bank like TD, explore government-backed advice, or consider a private lender, always weigh the risks and rewards.

It’s your home, your future — and your decision. Just make sure it’s an informed one.

FAQs About Second Mortgages in Canada

Can I get a second mortgage with bad credit?

Yes, especially through private lenders. You’ll pay more in interest and fees, but bad credit doesn’t automatically disqualify you.

How long does it take to get a second mortgage?

Banks can take 1–2 weeks. Private lenders can approve you in 24–72 hours.

Can I refinance my second mortgage later?

Absolutely — many people refinance their second mortgage once they improve their credit or gain more equity.

Will a second mortgage affect my credit score?

It can, especially if you miss payments or carry high debt. However, used responsibly, it may help consolidate and pay down high-interest debts.

Are second mortgages regulated in Ontario?

Yes. Banks follow federal regulations. Private lenders are regulated provincially — always deal with licensed brokers or institutions.