Syndicated Mortgages in Canada: Real Estate Goldmine or Financial Trap?

Ever dreamt of investing in real estate but thought you needed millions in the bank? What if I told you there’s a way for everyday investors to step into the world of major developments, without owning a skyscraper?

Welcome to the world of syndicated mortgages, a real estate investment that’s got everyone talking (and regulators watching). But before you dive in, there’s a whole lot you need to know. Let’s break it all down, blog-style.

What Is a Syndicated Mortgage?

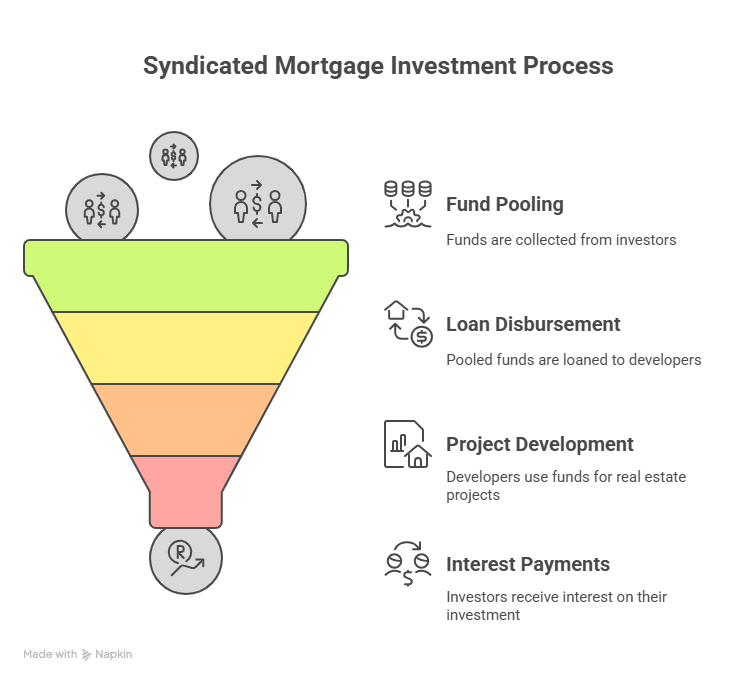

Think of a syndicated mortgage like a potluck dinner. Everyone brings something to the table, except instead of casseroles, it’s cold hard cash. This pooled money is then loaned to a real estate developer. In return? You get interest payments (ideally) and a slice of a potentially juicy return.

🔑 Key takeaway: You don’t have to fund the whole mortgage. You’re just one of many investors, all backing a single real estate project.

Why Are People So Hyped About These?

Let’s be real, who doesn’t want passive income from real estate without dealing with tenants or leaky pipes?

Here’s what makes syndicated mortgages seem so darn attractive:

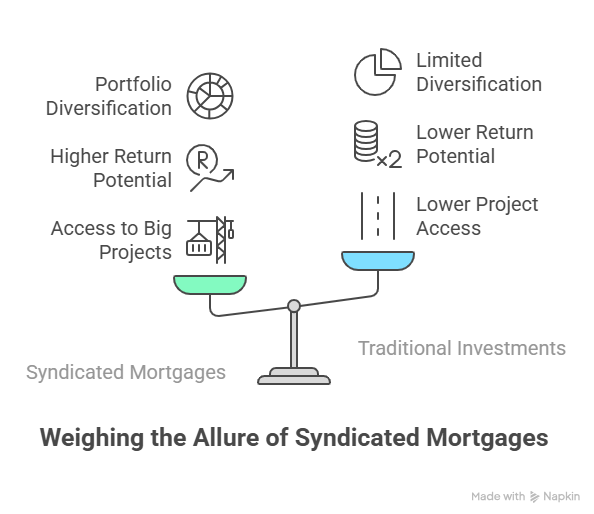

✅ Access to Big Projects: Fancy condo downtown? Student housing near a major campus? With SMIs, you can get in on it.

✅ Potential for Higher Returns: Forget 1% GICs. Some syndicated mortgages dangle 8–12% annual returns.

✅ Diversification: Got stocks and ETFs? Add a little real estate flavor to your portfolio.

Sounds dreamy, right? Not so fast…

The Fine Print Fallout: Risks You Might Be Ignoring

We’ve all seen those investment pitches that scream “guaranteed returns” in bold. Spoiler: no investment is truly guaranteed, and syndicated mortgages can be riskier than they appear.

Let’s get into the real talk:

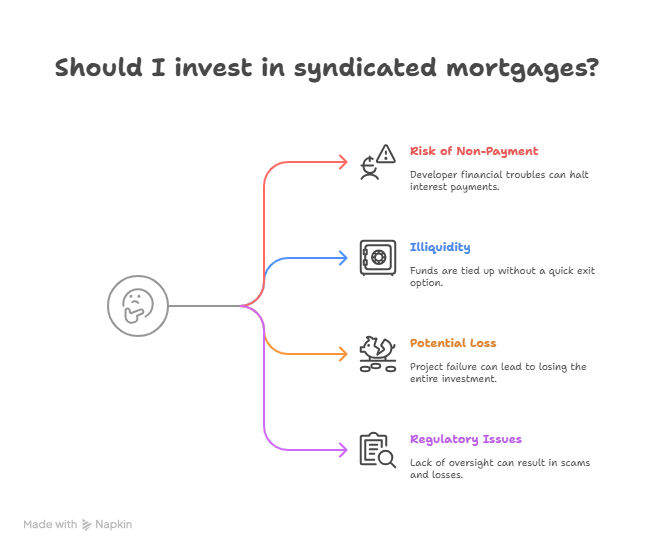

⚠️ You Might Not Get Paid: If the developer hits financial trouble, your interest payments could dry up, fast.

⚠️ Your Money’s Tied Up: There’s no “sell” button like with stocks. You’re in for the long haul.

⚠️ You Could Lose Everything: If the project fails and the property gets foreclosed, you might walk away with nada.

⚠️ Regulatory Loopholes: For years, shady brokers sold SMIs without real oversight. Many investors got burned.

Case in Point: Fortress Real Developments

Grab the popcorn because this is where things get spicy. Fortress Real Developments was once the poster child of syndicated mortgages in Canada. It raised over $700 million from over 11,000 investors.

The result? Investigations revealed huge commissions and fees gobbled up investor money. Projects stalled. People lost life savings. Class-action lawsuits exploded.

💣 Moral of the story: Always read the fine print and don’t get starry-eyed over high returns.

The Regulatory Wake-Up Call (a.k.a. The 2021 Overhaul)

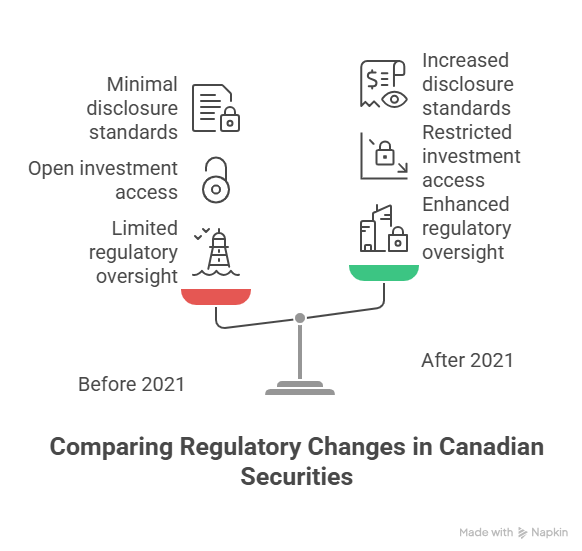

After years of messy cases like Fortress, Canadian regulators finally said, “Enough is enough.”

In March 2021 (July for Ontario and Québec), the Canadian Securities Administrators (CSA) rolled out a major regulatory overhaul.

Here’s what changed:

📌 Syndicated Mortgages = Securities

Now regulated under provincial securities laws, not just mortgage rules.

📌 OSC Took the Wheel (in Ontario)

The Ontario Securities Commission now oversees non-qualified SMIs, bringing in stricter standards.

📌 Tighter Exemptions

Only qualified investors can buy into riskier syndicated deals.

📌 More Disclosure

You now get way more info upfront. No more shady “just trust us” pitches.

Qualified vs. Non-Qualified SMIs: What’s the Difference?

Okay, this part’s kinda nerdy but super important.

🔍 Qualified Syndicated Mortgages

-

Secured against a residential property (usually 4 units or less)

-

Low loan-to-value ratio

-

Must meet very specific criteria

= Less risky, more investor-friendly

🔥 Non-Qualified Syndicated Mortgages

-

Bigger, commercial or early-stage projects

-

Higher risk, more regulatory hoops

= Proceed with caution

If you’re seeing promises of 12% returns on a hotel that hasn’t been built yet, you’re likely dealing with a non-qualified SMI.

Thinking of Investing? Here’s What You Must Do First

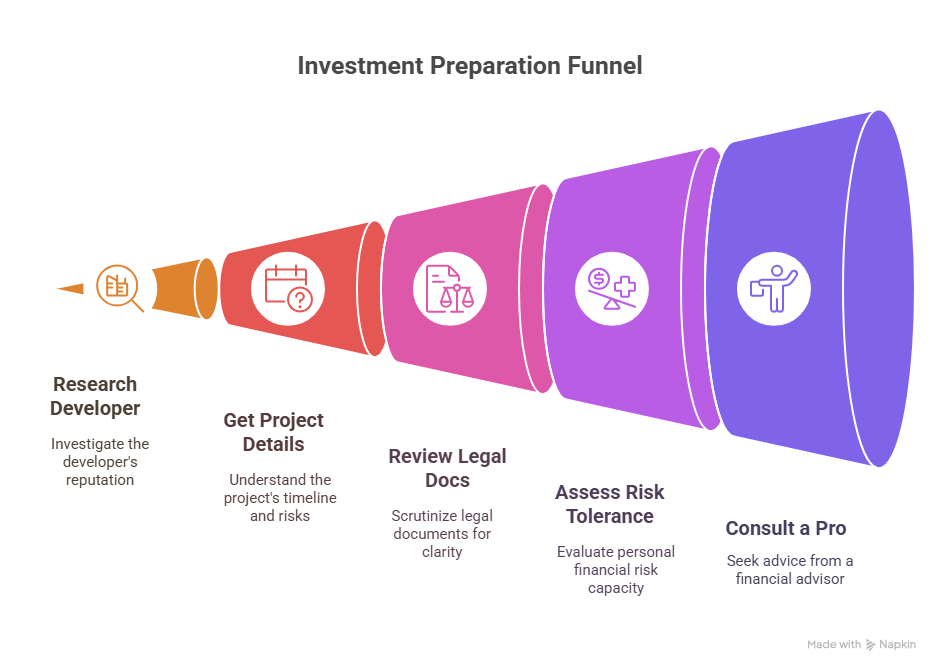

📚 Knowledge is your best defense. Before signing anything, run through this checklist:

🕵️♂️ Research the Developer

Do they have a solid track record? Google is your friend—use it.

📑 Get the Project Details

What’s the timeline? What are the risks? Don’t settle for vague answers.

🧾 Review the Legal Docs

Yes, they’re long and boring. Read them anyway—or hire a lawyer.

📊 Know Your Risk Tolerance

Can you afford to lose this money? Be honest with yourself.

💬 Talk to a Pro

A licensed financial advisor can save you from a world of hurt.

Real Talk: Are Syndicated Mortgages Still Worth It in 2025?

It depends. For seasoned investors with high risk tolerance and access to solid opportunities? Maybe.

For beginners chasing “easy” returns? Probably not.

The rules are tighter now, but that doesn’t make syndicated mortgages foolproof. It just makes them less shady—and that’s not the same as safe.

Final Thoughts: Is This Your Real Estate Side Hustle or a Mirage?

Syndicated mortgages are like rollercoasters: thrilling, risky, and definitely not for the faint-hearted. If you’re thinking of getting in, do your homework, double-check the paperwork, and trust your gut.

Remember, if something sounds too good to be true… 🧠 it probably is.

FAQs: Real Questions from Real Investors

Can I invest in a syndicated mortgage through my RRSP or TFSA?

Yes, some SMIs can be held in registered accounts, but it depends on the structure. Make sure it qualifies and talk to your financial institution first.

How do I know if a syndicated mortgage is legit?

Check if the dealer is registered with your provincial securities regulator and review the offering memorandum carefully.

Are syndicated mortgages a good hedge against inflation?

They can be since they’re tied to real estate, but the risk of capital loss might outweigh that benefit. It’s not a guaranteed inflation hedge.

What kind of returns can I realistically expect?

Historically, SMIs have offered returns between 6% and 12%—but that’s before considering risk. High returns = high danger.

Who regulates syndicated mortgages in Canada now?

Mostly your provincial securities commissions—like the Ontario Securities Commission (OSC). They’ve taken over oversight from mortgage regulators for many SMI deals.