The Ultimate Guide to Mortgage Pre-Approval in 2025

Buying a home is one of the biggest financial decisions you’ll ever make. But before you start browsing listings or making offers, there’s one crucial step: mortgage pre-approval. Think of it as getting your golden ticket to the real estate market—it tells you how much you can afford and shows sellers that you’re a serious buyer.

In this guide, we’ll walk you through everything you need to know about mortgage pre-approvals, from the process to the best tips for securing the lowest rate possible.

What is Mortgage Pre-Approval?

Imagine walking into a store without knowing how much money is in your wallet. That’s what house hunting without mortgage pre-approval is like. A mortgage pre-approval is an official confirmation from a lender stating how much they’re willing to lend you for a home purchase. It’s based on your financial situation, including income, credit score, and debt levels.

Unlike pre-qualification, which is more of a rough estimate, pre-approval involves a detailed financial check and holds more weight with sellers.

Why is Mortgage Pre-Approval Important?

1. Know Your Budget

No one wants to fall in love with a home they can’t afford. Pre-approval helps set realistic expectations by showing you a clear price range.

2. Stand Out to Sellers

In a competitive market, pre-approved buyers have the upper hand. Sellers prefer buyers who have financing secured because it reduces the chances of a deal falling through.

3. Lock in Your Interest Rate

Many lenders allow you to lock in an interest rate for up to 120 days. This means if rates go up while you’re house hunting, your rate stays the same.

4. Speed Up the Closing Process

Since your financial documents have already been reviewed, the final approval process when you find a home is much quicker.

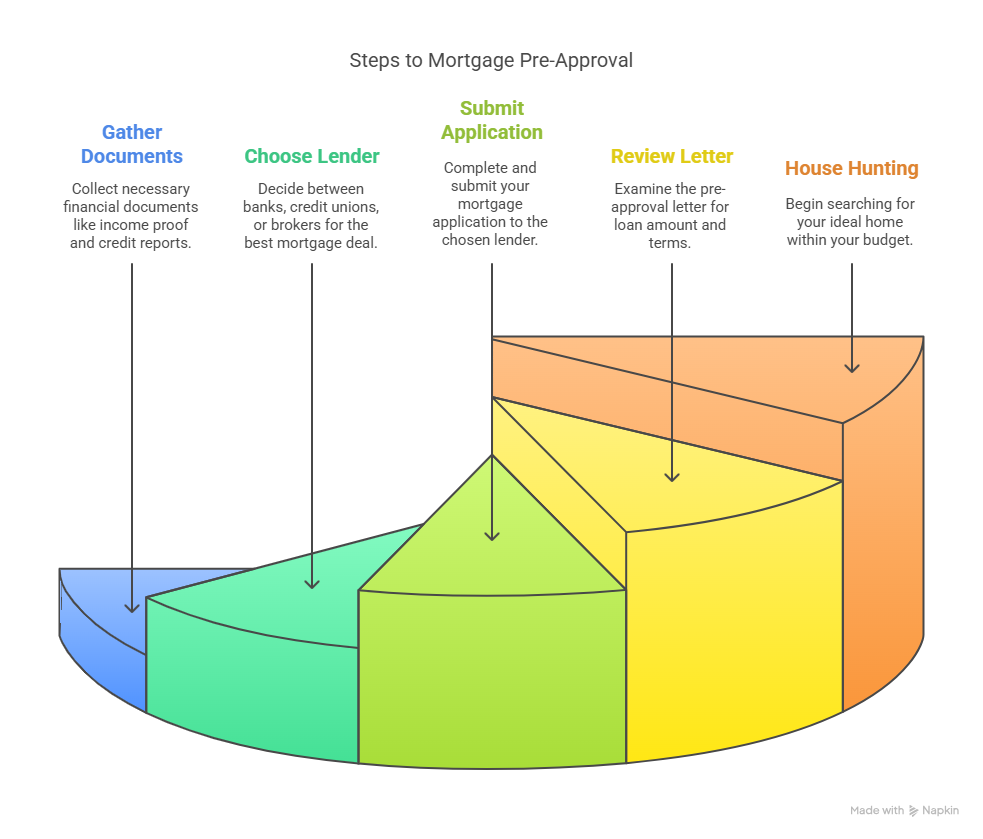

How to Get Pre-Approved for a Mortgage

Step 1: Gather Your Financial Documents

Lenders want proof that you can afford a mortgage. Be prepared to provide:

-

Proof of Income: Recent pay stubs, tax returns, or business financial statements (if self-employed).

-

Proof of Assets: Bank statements, investment accounts, or other assets that can be used as a down payment.

-

Credit Report: Your lender will check your credit history and score.

-

Debt & Liabilities: Student loans, car loans, credit card balances, and any other debts.

-

Employment Verification: A letter from your employer confirming your position and salary.

Step 2: Choose a Lender

You can apply for pre-approval through:

-

Banks – Traditional and often offer bundled services.

-

Credit Unions – May have lower rates and better customer service.

-

Mortgage Brokers – Shop around for the best deals on your behalf.

Step 3: Submit Your Application

Once you’ve chosen a lender, you’ll need to submit your application. Some lenders allow you to apply online for faster processing.

Step 4: Review Your Pre-Approval Letter

If approved, your lender will provide a pre-approval letter stating how much they’re willing to lend you and the interest rate.

Step 5: Start House Hunting

Now comes the fun part—searching for your dream home with a realistic budget in mind.

Common Mistakes to Avoid When Getting Pre-Approved

1. Making Large Purchases Before Closing

Thinking about buying a new car or maxing out your credit card? Don’t. Major financial changes can lower your credit score and jeopardize your approval.

2. Switching Jobs

Lenders like stability. A sudden career change might make them rethink your financial reliability.

3. Not Comparing Lenders

The first offer isn’t always the best one. Shop around and negotiate for the lowest interest rate.

4. Ignoring Your Credit Score

A low credit score can mean higher interest rates—or even denial. Check your credit report beforehand and fix any errors.

5. Assuming Pre-Approval = Guaranteed Loan

Pre-approval is not a final loan commitment. If your financial situation changes, the lender can still deny your mortgage at the last moment.

How Long Does a Mortgage Pre-Approval Last?

Most pre-approvals last 60 to 120 days, depending on the lender. If your approval expires before you find a home, you may need to reapply.

What Happens If You’re Denied Pre-Approval?

If your application is rejected, don’t panic. Here’s what you can do:

-

Ask Why: Get a detailed explanation from the lender.

-

Improve Your Credit Score: Pay down debts and make payments on time.

-

Increase Your Down Payment: A larger down payment reduces risk for lenders.

-

Try a Different Lender: Some lenders have different approval criteria.

Final Thoughts: Is Mortgage Pre-Approval Worth It?

Absolutely. Mortgage pre-approval isn’t just another step in the home-buying process—it’s your golden ticket to a smoother, stress-free purchase. It helps you budget realistically, compete with confidence, and lock in a great interest rate before market fluctuations.

Whether you’re a first-time homebuyer or looking to refinance, taking this step will save you time, money, and potential heartache down the road.

FAQs

Does getting pre-approved affect my credit score?

Yes, but only slightly. Mortgage pre-approvals result in a hard inquiry, which may lower your score by a few points temporarily.

Can I get pre-approved by multiple lenders?

Yes, and it’s a good idea! Multiple inquiries within a short period (usually 30 days) are typically counted as a single inquiry.

Is there a fee for mortgage pre-approval?

Most lenders offer free pre-approvals, but some may charge a small fee for credit checks.

Can I make an offer on a home without pre-approval?

Yes, but it’s risky. Sellers may prioritize offers from pre-approved buyers since there’s less uncertainty.

What happens if interest rates drop after I’m pre-approved?

If your lender offers a rate-lock feature, you’re protected. Otherwise, you may have to reapply to take advantage of the lower rate.